Contingent Value Rights and Similar Tools Are Becoming More Commonplace

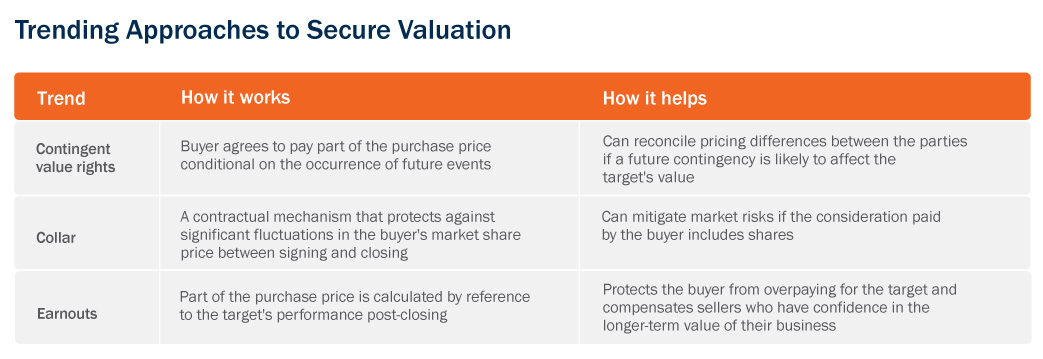

Of all the legal and business issues that arise in an M&A transaction, the most fundamental issue is valuation. If the buyer and seller cannot come to a meeting of the minds on the value of the business or the consideration to be paid, saving the deal becomes a matter of bridging that valuation gap. In 2014, we expect that buyers and sellers will increasingly use innovative pricing tools to reconcile their differences.

In the private company context, the most common way to bridge gaps in valuation is through an earnout formula. If the business performs as promised and achieves certain financial or other performance milestones over a period of time following closing, the seller is entitled to receive additional purchase price payments. This mechanism is attractive to sellers who have confidence in the long-term value of their business and want to be compensated for that value; earnouts are equally attractive to buyers who want to ensure they are getting what they pay for.

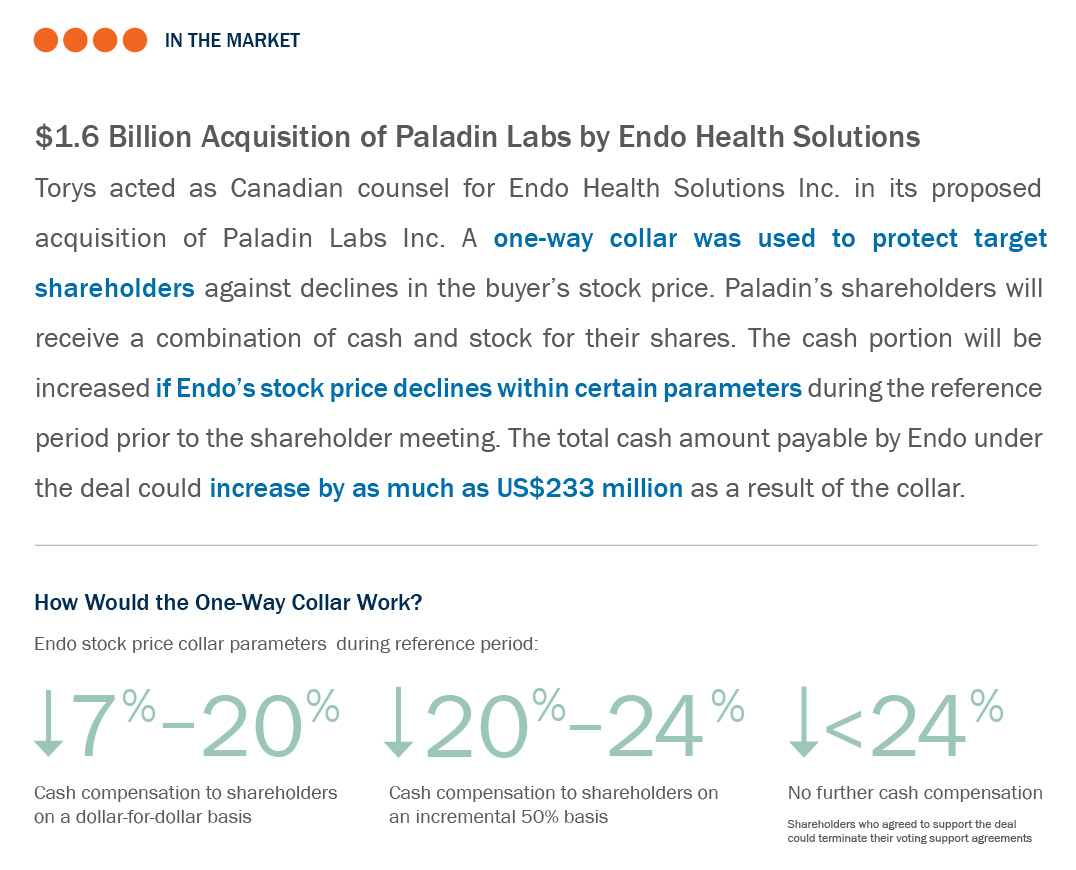

In the public company context, it is harder to find mechanisms to bridge valuation gaps between buyers and targets. One traditional method has been for the buyer to offer its stock as all or part of the consideration package to allow target shareholders to share in the upside of the combined company. However, that is not always an attractive alternative for target shareholders who may not want to be subject to the uncertainty associated with the buyer’s stock, including fluctuations in the price between the signing and closing of the transaction. To solve this problem, collar mechanisms can be employed. With a collar, target shareholders receive additional cash or shares of the buyer if the trading price of the buyer’s stock declines between the signing of the transaction and closing, or in some cases, during a period of time after closing.

Buyers and public company targets are also finding innovative structures to resolve uncertainty in the value of the target’s business in much the same way that earnouts do in the private company context. Contingent value rights (CVRs) give target shareholders a right to receive additional consideration if a specified milestone or threshold is achieved in the future. That payment can be a fixed amount or can vary according to a specified formula. CVRs have become fairly common in the pharmaceutical sector when the future value of a particular drug is highly uncertain and contingent on events such as regulatory approval or the outcome of a clinical trial. A CVR can be used to provide additional consideration to target shareholders if the drug achieves specified milestones. CVRs have also been used in other contexts, such as where the outcome of significant litigation is uncertain, allowing target shareholders to share in a successful result.

Given the more widespread acceptance of the CVR structure in the pharmaceutical industry, we expect to see this structure used more frequently in other sectors. CVRs are complex and raise a host of legal issues, including issues related to transferability and ongoing public reporting requirements under Canadian or U.S. securities laws if the CVR is considered a “security,” as well as tax and accounting issues. Care must also be exercised in the negotiation and drafting of the milestones and payment calculations under CVRs. Earnouts have historically been viewed as being prone to disputes and litigation as a result of differing interpretations of accounting formulas, or buyers manipulating outcomes to avoid or minimize the cost of an earnout. However, if properly structured, CVRs could provide the missing piece to getting the deal done.

As CVRs become more commonplace in other industries, there will be added pressure to develop payment triggers and formulas that are easily determined and quantifiable, as well as covenants to ensure that the buyer is not motivated to manage the business to deliberately avoid triggering a CVR payment.

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Janelle Weed.

© 2024 by Torys LLP.

All rights reserved.

Tags