Authors

As the pandemic continues to batter certain industries—in particular, retail, travel, hospitality and entertainment—some businesses in these segments are expected to (or already have) become increasingly distressed and, in some cases, insolvent.

A by-product of this challenging environment is that M&A opportunities may be available for prospective strategic purchasers, even in concentrated markets, which would not have been possible in ordinary circumstances.

Strategic buyers looking to acquire competitors’ assets in these ailing industries may find they are able to advance these deals and/or withstand regulatory challenge from Canada’s Competition Bureau under the ‘failing firm defence’. In this article, we discuss the regulator’s latest approach to ‘failing firm’ acquisitions and the pandemic’s impact on those cases.

The Competition Bureau’s approach to failing firm cases

Under the Competition Act, mergers that will or will likely result in a substantial lessening or prevention of competition are challenged by the Commissioner of Competition (Commissioner). However, “whether the business, or a part of the business, of a party to the merger or proposed merger has failed or is likely to fail” is an important factor relevant to the Commissioner’s decision to challenge. This factor is commonly referred to as the “failing firm defence” (though as described below, it is not a complete defence).

The Competition Bureau (Bureau) recently restated its approach to failing firm arguments in American Iron & Metal Company Inc.’s (AIM) acquisition of Total Metal Recovery Inc. (TMR). AIM and TMR both operated scrap metal processing facilities in Québec. Although not subject to pre-merger notification under the Competition Act, the Bureau commenced a formal inquiry into the acquisition of TMR by AIM. In its review of the transaction, the Bureau undertook an analysis to determine whether TMR was truly a “failing firm”. The Bureau reiterated that failing firm arguments are not a complete defence to an otherwise anti-competitive merger and must be supported by thorough and compelling evidence. The Bureau confirmed it will rigidly assess the relevant criteria in such cases, namely:

- Insolvency or imminent bankruptcy. A firm is failing or likely to fail if: i) it is insolvent or is likely to become insolvent; ii) it has initiated or is likely to initiate voluntary bankruptcy proceedings; or iii) it has been, or is likely to be, petitioned into bankruptcy or receivership.

- No competitive alternatives. The Bureau will examine the likelihood of various counterfactual scenarios to a merger and the expected levels of competition in the market under such scenarios. If a competitive alternative exists, the Bureau could still conclude that the proposed merger will or is likely to result in a substantial lessening of competition, which could form the basis of a challenge.

Under the first prong of this analysis, merging parties should be ready to provide the Bureau with detailed business documents to facilitate a careful assessment. This includes: financial statements, liquidity reports and forecasts; business plans; correspondence to and from creditors; as well as documents related to plans to initiate bankruptcy proceedings or seek creditor protection under the Companies’ Creditors Arrangement Act (CCAA).

While parties should not assume a target’s poor financial performance will automatically permit an otherwise anticompetitive transaction, there may be certain circumstances where it is preferable that productive assets be in the hands of a competitor rather than lost to the market.

Under the second prong of the analysis, the Bureau will consider whether the target could be successfully restructured to prevent failure, whether there were any other competitively preferable buyers (including evidence of a bona fide search by the vendor for such buyers and whether buyers could finalize a transaction in a timely way), and whether liquidation of the target’s assets would be competitively preferable to the transaction.

While parties should not assume a target’s poor financial performance will automatically permit an otherwise anticompetitive transaction, there may be certain circumstances where it is preferable that productive assets be in the hands of a competitor rather than lost to the market. Parties must be prepared to submit extensive information to the Bureau evidencing that the target is truly failing and there are no competitively preferable alternatives.

The impact of COVID-19 on failing firm cases

Bureau officials have confirmed that notwithstanding the challenges emanating from the COVID-19 pandemic, they have no intention of relaxing the rigid requirements to satisfy the failing firm criteria. They have further noted that the pandemic has not resulted in a proliferation of failing firm cases.

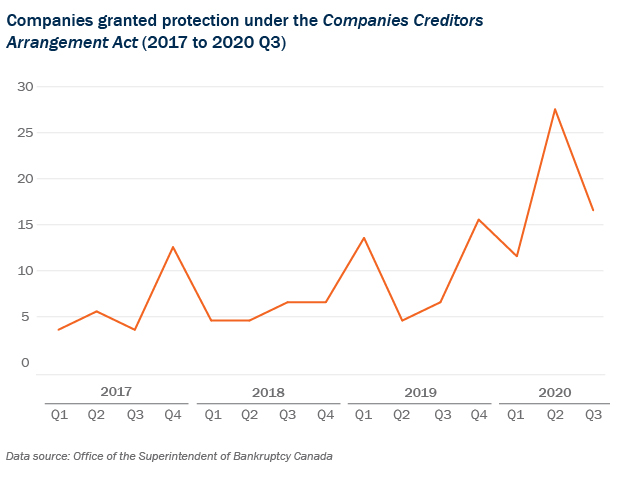

However, the data shows that there has been a steadily increasing number of Canadian businesses seeking protection from creditors under the CCAA since the onset of the COVID-19 outbreak in Canada towards the end of Q1 2020, as illustrated below:

This spike in distressed companies will likely increase the number of acquisition targets with productive assets—and, relatedly, the potential application of failing firm arguments.

Conclusion

While the Bureau has set a high bar for the application of failing firm arguments and will continue to rigorously assess their use, the economic consequences of the COVID-19 pandemic may present opportunities to keep productive assets operating in competitors’ hands. This may be preferable even in concentrated industries, where the alternative would be to let productive assets go to waste at a time when all cylinders of the Canadian economy need to be firing to emerge from the depths of the crisis.

Subscribe and stay informed

Stay in the know. Get the latest commentary, updates and insights for business from Torys.

Stay in the know. Get the latest commentary, updates and insights for business from Torys.

Subscribe Now