The Canadian deal markets are thriving.

As the COVID-19 vaccination program continues to roll out across North America, corporate Canada’s decision-makers are putting domestic and cross-border growth plans to work, taking advantage of the robust economic outlook in pursuit of strategic transactions. Low debt funding costs, strong equity markets and the abundance of capital are underpinning the healthy environment for M&A, and all indicators suggest that the dealmaking momentum should persist into year end and beyond.

Canadian domestic M&A

The volume of domestic deal activity year to date has increased by 49% as compared to same period last year. Aggregate deal value has also tripled as large domestic plays point to the confidence of boards and CEOs in the current environment (Figure 1). For example, earlier this year Rogers Communications Inc. and Shaw Communications Inc. announced an agreement under which Rogers will acquire all of Shaw’s issued and outstanding Class A shares and Class B shares in a transaction valued at approximately C$26 billion (one of the largest domestic M&A transactions in the last decade)1.

Figure 1. Canadian domestic M&A activity

|

Deal activity |

2020 - H1 |

2021 - H1 |

2021 Annualized |

|---|---|---|---|

|

Volume of transactions |

615 |

918 |

1836 |

|

Deal value (C$ billion) |

$14.12 |

$87.9 |

$175.8 |

Source: Bloomberg, based on M&A deals announced from January 1 - June 30, 2021. Excludes terminated and withdrawn deals.

Canadian outbound M&A

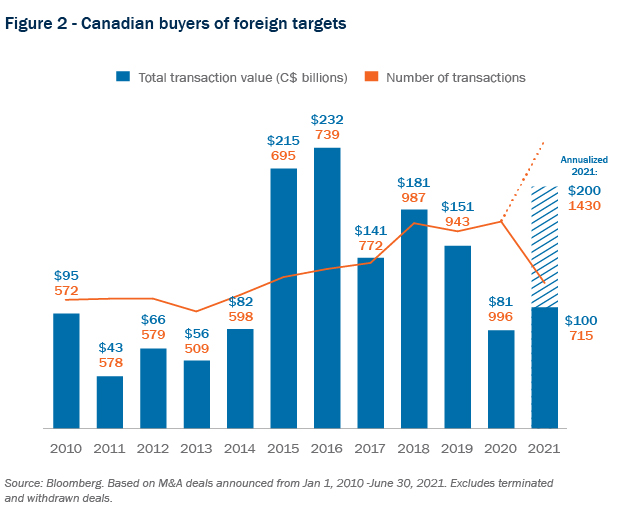

With economic recovery in sight, Canadian dealmakers are also broadening their reach to access larger markets in the U.S. and internationally, pursuing global scale and capitalizing on market disruptions to implement ambitious business plans. The total value of Canadian outbound M&A activity year to date has already surpassed 2020 levels, and annualized deal count is anticipated to exceed total deal volume recorded last year (Figure 2).

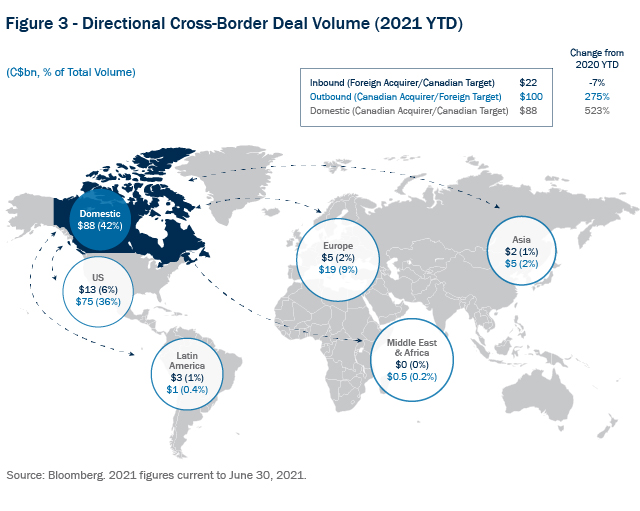

The U.S. remains the destination of choice by deal count and value for Canadian outbound investments (Figure 3) by both strategic and financial buyers. Macro-economic factors are significant drivers of heightened cross-border deal activity, with access to larger markets, expansive continental reach and the low cost of debt remaining important for dealmakers. For example, CN and Kansas City Southern recently announced their US$33.6 billion merger (upsetting the previously agreed combination between Kansas City Southern and Canadian Pacific Railway Ltd.) to create a groundbreaking North American railway connecting ports and rails across the United States, Mexico and Canada2.

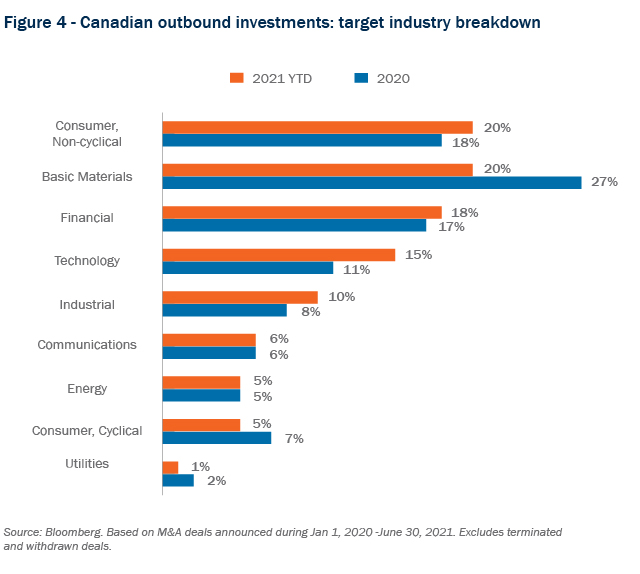

The technology sector had the strongest growth among sectors in Canadian outbound investments, with a 4% increase in total deal value recorded so far this year relative to 2020 (Figure 4). Technology has shown resilience to the effects of the pandemic: as people and businesses were forced to carry on business remotely, companies reassessed, and in many cases, expanded or evolved their technology use and digital strategies to maintain competitive strength and increase revenue growth. The expansion of online commerce, video and electronic communications technology and innovative healthcare research and applications are some recent examples of technology industries in transformation.

Beyond the U.S., Canadian dealmakers are also seeking growth opportunities in Europe, with France, the U.K. and Spain appearing in the top five countries with the most capital invested by Canadian investors in 2021 year to date (Figure 3). For example, Intact Financial Corporation, together with Tryg A/S, recently completed their £7.2 billion acquisition of RSA Insurance Group plc3.

Altogether, this surge in cross-border deal activity underscores a recognition by corporate Canada and dealmakers of the current opportunities across different international markets to build scale and accelerate growth as they emerge from the pandemic.

Inbound M&A

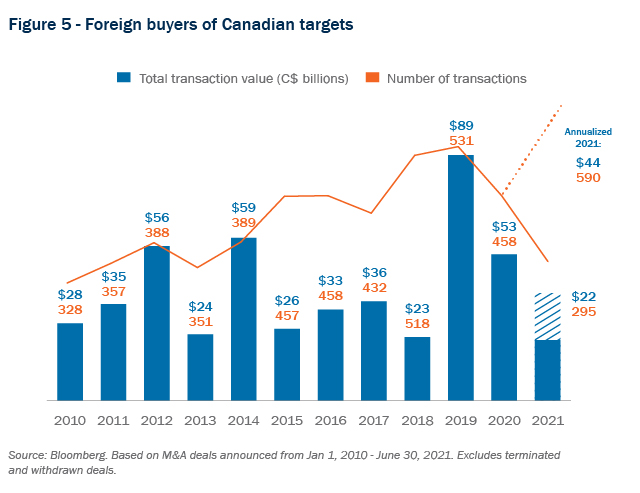

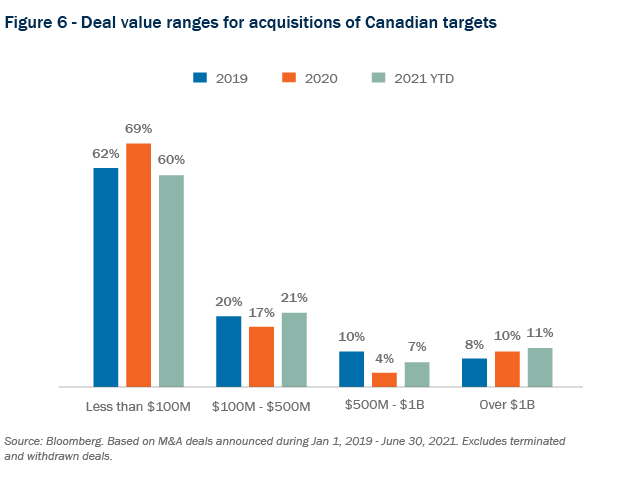

On an annualized basis, the aggregate value of foreign investment in Canada appears to be on the decline relative to deal activity recorded in 2020, with total deal value projected to be approximately $44 billion in 2021. However, activity levels are strong, and are expected to surpass the peak level recorded in 2019 (Figure 5). The U.S. remains the largest inbound source of foreign investment in Canada (Figure 3). While most deals (60%) were valued less than $100 million, there has been a 3% increase in deals valued between $500 million and $1 billion (Figure 6).

Conclusion

As global markets continue to adjust to the widespread disruption of the pandemic, business leaders in Canada have been bold and proactive in their approach to maximizing opportunities in a changed—and changing—landscape. As sectors and markets remain in a state of ongoing recalibration, it will be interesting to see the ripple effects on Canadian and cross-border M&A for the rest of the year and into 2022.

_________________________

1 Torys is representing Rogers Control Trust on this transaction.

2 Torys is representing CN in this transaction.

3 Torys provided insurance regulatory and related advice to Intact Financial Corporation.

Subscribe and stay informed

Stay in the know. Get the latest commentary, updates and insights for business from Torys.

Stay in the know. Get the latest commentary, updates and insights for business from Torys.

Subscribe Now