Trends in financial services: M&A and capital markets

Authors

(Ricco) A.S. Bhasin

David A. Seville

David A. Seville

Across the financial services industry, deal activity has remained strong as financial institutions explore emerging opportunities to invest capital, refine their digital platform strategies and adjust operations and activities in the wake of the growing ESG focus and drive to hit their net zero targets. At the same time, the capital markets landscape for financial institutions is evolving, with market participants exploring new and innovative ways to raise capital. Altogether, these latest developments signal a robust transactions environment for the industry and an overall positive outlook for 2022.

A buoyant M&A market

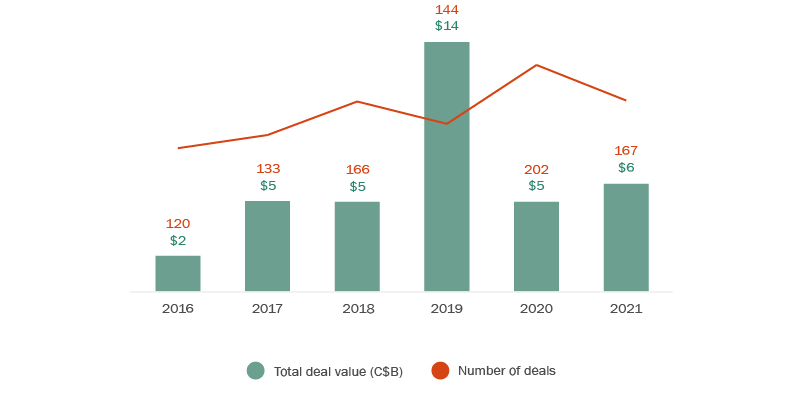

2020 was the “second busiest year”1 since the GFC in financial services M&A and activity in 2021 has continued at a torrid pace. Deal activity has been exceptionally strong in asset management, payments fintech, insurance, banks, loyalty partnerships, and international bancassurance, as set out in the chart below.

M&A transactions with Canadian financial services targets

The financial services industry is seeing the active pursuit of M&A opportunities, with M&A remaining a key pillar in financial services strategies. The recently released 2022 Bank Director M&A Survey shows that over half of the respondents view M&A as an important piece of their institutions’ growth in 20222. However, as regulatory regimes continue to evolve in alignment with technology and other innovations, dealmakers in the sector will want to keep watch on changes to regulatory approach, new frameworks and guidance, and changing industry best practices to help mitigate risk. Specifically, the industry faces increasing accounting, tech, margin, litigation and regulatory pressures. Navigating these waters can be challenging, but the rewards can be plentiful. Three trending drivers and issues for financial services M&A will influence deal activity in 2022.

1. Capital, capital, capital!

When looking at the market participants in 2021, they are generally flush with capital and are coming off the back of strong earning and return performances through the year. For banks and insurance companies, many regulators around the globe have or are in the process of lifting dividend and similar restrictions that were put into place during the height of the COVID-19 crisis in 2020/2021. Dividend “hikes” and share buy-backs are being announced daily, signaling a return of capital to shareholders. Financial institutions took prudent and conservative steps to protect against potential excess losses and margin compression during 2020/2021 and are now moving into 2022 well capitalized. Asset managers, private equity venture capital and other corporates (e.g., grocers, telecom) are similarly flush with cash, ready to deploy. Industry players will have important choices to make about capital allocation, weighing-up continuing to increase dividend payments, making share buy-backs, investing in organic growth, and M&A.

2. Focus on digital (and traditional) roll-ups.

Though we’ve seen some recent examples of large blockbuster institutional M&A in financial services, notably in the mid-market (U.S.) banking, insurance and asset management, the industry is seeing increased relative volumes of roll-up transactions. These transactions tend to be smaller in dollar value, but are playing an important role in the “platform” strategies for regulated and unregulated participants alike. Leading the charge as a material growth area is fintech (including its subsets like insuretech) with the seminal transactions happening in payments, lending and wealth management. Coupled with organic growth and innovation, large financial institutions view these acquisition roll-ups of fintech as critical to having a strong platform, providing superior digital experiences for consumers and therefore supporting customer acquisition and retention while enjoying economies of scale.

That said, as financial services can be scaled quickly, with accretive long-term and “sticky” earnings, more traditional financial services transactions remain on the rise as well, including in banking, wealth management, insurance, lending portfolios and loyalty arrangements. All of this activity in the face of large capital coffers and low borrowing rates means there is increasing competition for assets in the space and valuations are soaring. Though execution discipline will remain important, what is plentiful in the market is cash and buyers. Therefore, as recent history has shown long-term, steady and sticky returns on capital in financial services, we expect this high activity trend to continue with market participants not wanting to miss out on opportunities for growth.

3. ESG and governance

There continues to be an increased focus on ESG factors in M&A. Pension funds, banks, insurance companies and other market participants have been announcing ESG commitments. As examples, the CDPQ has committed to Net Zero Portfolio by 20503, as has Manulife4, Sun Life5 and Ontario Teachers6 and other prominent funds. The Glasgow Financial Alliance has shone recent light on market participation in these initiatives for global financial institutions, preceded by the large Canadian banks’ commitment to join Mark Carney in the global “Net-Zero Banking Alliance”7. We expect this trend to continue and buyers of financial services will need to be cognizant of the impacts on operations and investing. We are seeing specific tailoring of provisions in deal agreements for these complex ESG issues—and more broadly, these activities will change approaches in lending, asset management and other areas of financial services assets.

The focus on ESG also flows to the boardroom for financial services organizations. As Canadian corporate law mandates that directors consider all stakeholder interests, and not just those of shareholders, including in the context of a prospective M&A deal. For financial services buyers or sellers, especially federally-regulated entities, the interests of depositors, policyholders and creditors are always prominent in board deliberations. In consideration of ESG issues and how a target company may be operating and what its interests are and how the business model will fold in to your organization, board decision-making may have to balance profits with care and attention to the ESG footprint, ensuring that directors have the information and advice necessary to make reasonable business judgments on the transaction before them.

Novel transactions in the capital markets

First-of-kind and other novel transactions are shaping the financial institutions capital markets. Market participants are adopting new structures to raise capital, and for the first time in over two decades, a Canadian insurer is nearing completion of a demutualization. These latest developments—including key aspects of these transactions—are set out below.

1. A new wave of limited recourse capital notes

A number of Canadian banks (RBC, NBC, BMO, CIBC, Scotiabank (BNS), TD, CWB and LBC), life insurance companies (Manulife, Sun Life and Empire Life), and one Canada Business Corporations Act (CBCA) insurance holding company (Great-West Lifeco), have issued “limited recourse capital notes”, or LRCNs, in public offerings to institutional investors in 2021. The LRCN structure in all of these offerings, save those by BNS, consisted of two instruments: 1) deeply subordinated interest-paying LRCNs that are issued to investors; and 2) perpetual, non-cumulative preferred shares that are issued to a trust to satisfy the recourse of LRCN holders upon the occurrence of certain prescribed recourse events.

The BNS structure in June 2021 introduced an innovation: the instrument issued to the trust is a perpetual note, rather than a perpetual preferred share. The effective ranking of the perpetual notes is higher than of the perpetual preferred shares and is reflected in the non-viability contingent capital (NVCC) multiplier on the perpetual notes of 1.25 versus 1.0 on perpetual preferred shares. BNS also recently became the first Canadian financial institution to offer USD-denominated LRCNs with its October 2021 US$600 million offering of 3.635% LRCNs Series 2. The underlying perpetual notes are a tax-efficient instrument to issue on a cross-border basis.

2. New form of preferred share offering targeting institutional investors

In November 2021 RBC filed a prospectus supplement for a new type of NVCC preferred share targeted for institutional investors. Unlike the traditional rate reset $25 face amount, exchange listed, preferred shares historically issued by financial institutions to predominantly retail investors, the RBC preferred shares have a $1,000 face amount, are not listed and the distribution is restricted to accredited investors that are not individuals unless they also qualify as a “permitted client” under Canadian securities laws. The substantial face amount, lack of an exchange listing and restricted distribution are consistent with prudential regulatory efforts to encourage institutional rather than retail ownership of contingent capital instruments (for more on regulatory developments in the industry, read our article “Regulatory developments in the financial services sector”).

3. First-of-kind Bank at-the-market distribution program

Canadian Western Bank (CWB) became the first Canadian bank to establish an at-the-market (ATM) distribution program with its May 2021 $150 million common shares shelf prospectus supplement. The co-lead underwriters on the program are National Bank Financial and BMO Capital Markets. The ATM program provides CWB with the ability to raise tier one capital from time to time at relatively low cost 2% placement commissions versus conventional equity offering commissions of 4-5%.

4. Much-anticipated property and casualty insurance company demutualization

The long-awaited demutualization of Economical Mutual Insurance Company (Economical) moved closer to completion with the filing in November 2021 of the supplemented PREP prospectus for the initial public offering by its newly formed holding company, Definity Financial Corporation (Definity).

Definity is currently governed by the Insurance Companies Act (Canada) (ICA) and is therefore subject to the cap on indebtedness of 2% of its total assets. This cap has served to limit the amount of leverage that property and casualty insurance companies governed by the ICA are permitted to raise. Interestingly, the IPO prospectus indicates that subject to certain regulatory amendments and approvals, Definity intends to continue as a company governed by the CBCA. As a CBCA company, Definity will no longer be subject to the ICA cap on indebtedness. This will position Definity to raise greater amounts of indebtedness, including limited recourse capital notes, as compared to P&C companies subject to the ICA cap.

Another noteworthy aspect of the Definity IPO is the two cornerstone private placements that will close concurrently with the IPO. One investor is the Healthcare of Ontario Pension Plan (HOOPP), for 19.9% of the shares outstanding post-IPO, and the other investor is Swiss Re, for US$200 million. Both cornerstone private placements are subject to extended lock-ups, five years for HOOPP and three years for Swiss Re, subject to limited exceptions. HOOPP is entitled to two board nominees and Swiss Re is entitled to one board nominee. The Canadian P&C demutualization regulations provide for a two-year restriction on any shareholder acquiring more than 20% of any class of Definity’s voting shares (and Definity’s prospectus indicates that it expects that this will continue to apply to it as a CBCA company post-continuance). This two-year post-IPO take-over protection period is consistent with the take-over protection period in the life insurance company demutualization regulations under which Canada Life, Clarica, Manulife and Sun Life demutualized in the late 1990s. The cornerstone investors’ arrangements and extended lock-ups should provide Definity with take-over protection beyond the two-year statutory restriction.

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Janelle Weed.

© 2025 by Torys LLP.

All rights reserved.