Executive compensation: what is top of mind for boards in 2022?

This time last year, boards and compensation committees were primarily focused on how best to incentivize their management teams during the COVID-19 pandemic in the face of fluctuating share prices and uncertainty in financial performance. During 2021, we have seen evidence of recovery in many markets and companies are generally more optimistic now than they were last year. Companies have had an opportunity to analyze and adapt to the impact of COVID-19 on their compensation programs.

While still dealing with some continued market uncertainty, boards and compensation committees are now increasingly focused on retention and talent management, as well as other priorities. This article will highlight a few of the compensation trends we are seeing in the marketplace and provide some guidance with respect to what boards and compensation committees should be thinking about when implementing some of the more prevalent strategies.

This year, we collaborated with Hugessen Consulting to provide perspective and commentary on their annual Director Pulse Survey (the Survey). The Survey analyzes the responses of 75 Canadian director participants collected in the final two weeks of November 2021. The directors sit on a wide range of company boards, including with respect to ownership, industry, geography, and company size. The graphics and trends presented and discussed below are derived from the Survey.

Top board priorities

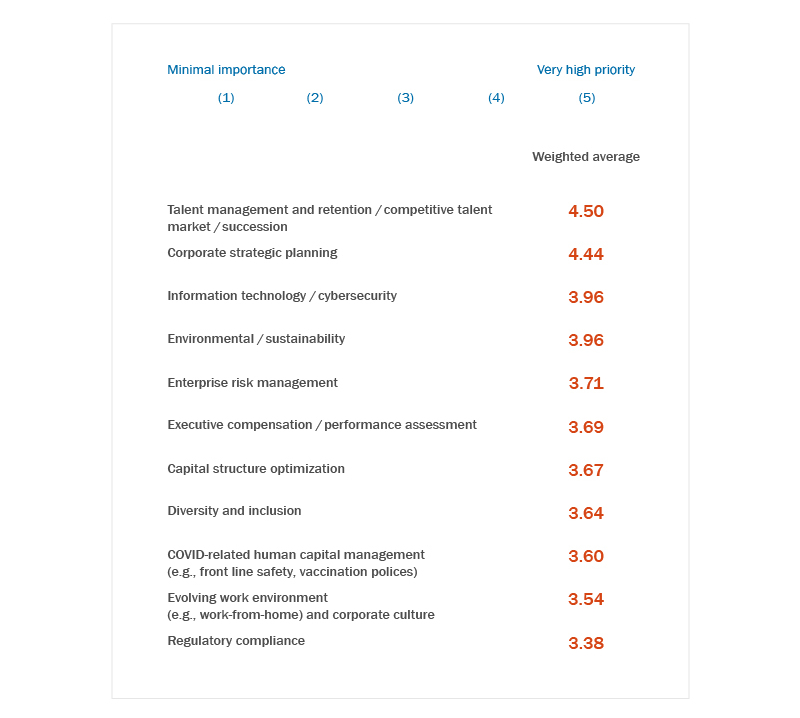

The Survey asked directors about top board priorities going into 2022 and talent management, retention and succession planning were at the forefront. Large-cap issuers drove this result, with 72% of their directors responding that talent management, retention and succession planning are very high priorities (see Figure 1 for a complete breakdown).

Figure 1: Top board priorities in 2022

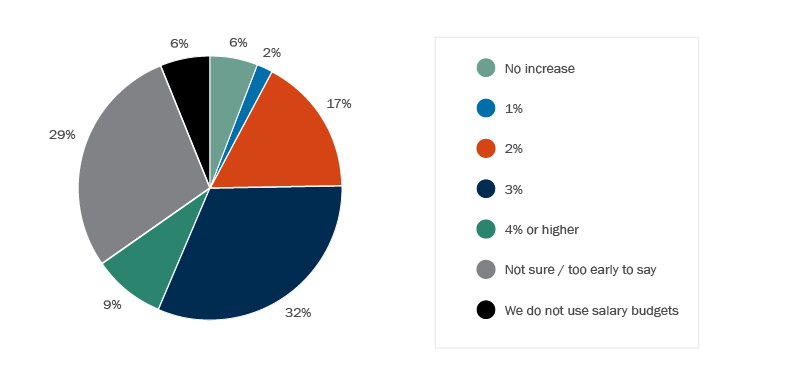

Having the right management team is crucial, so it is not surprising that talent management, retention and succession planning topped the list of board priorities for 2022. To retain top-level talent, we are seeing companies increasing base compensation and providing senior management with enhanced incentive opportunities. Going into 2022, 74% of directors who participated in the Survey anticipated an increase to executive salary budgets, the vast majority of which (86%) being equal to or above pre-COVID expectations (see Figure 2). Of those that expected a specific percentage increase, 54% indicated an increase of 3%, while 16% indicated an increase of 4% or above.

Figure 2: What increases do you expect for 2022 executive salary budgets?

These compensation increases may present an opportunity for companies to amend their current contractual arrangements or enter into new contractual arrangements with their management teams that provide greater protections for the company. Companies may consider implementing new or revised restrictive covenants, such as non-competition1 or non-solicitation obligations, or revising current contractual provisions to increase the likelihood of enforcement. For example, updating provisions governing the termination of the employment relationship in employment agreements or incentive plans, including in light of recent jurisprudence such as the Waksdale decision2 and the Ocean Nutrition decision3, may be desirable. However, companies should be cautious when proposing to amend existing contractual arrangements as it may present an opportunity for the employees to negotiate other enhanced entitlements.

Public companies will also want to consider their public disclosure obligations and anticipated stakeholder reaction before providing any increases in compensation or amending any executive employment agreements.

Use of Discretion in Modifying Targets and Determining Payouts

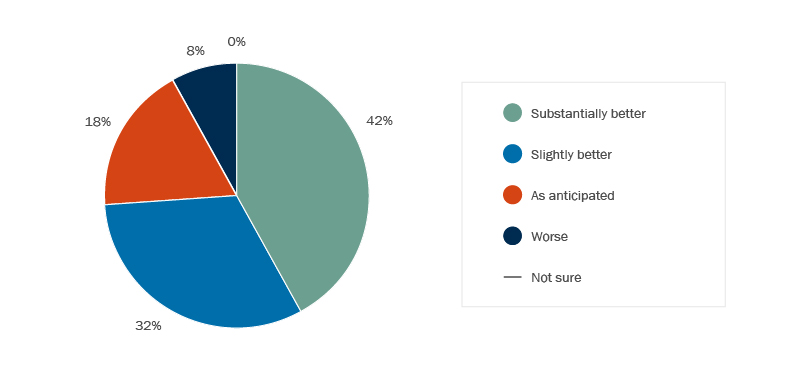

According to the Survey, 74% of respondent directors expected slightly or substantially better financial performance compared to expectations at the beginning of 2021 (see Figure 3).

Figure 3: What are your expectations for financial performance for 2022, compared to the beginning of 2021?

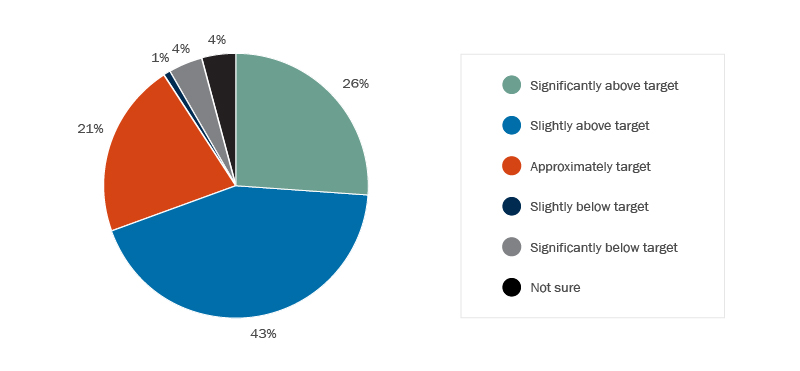

We expect these improved results to have a direct impact on compensation, as 90% of the respondent directors anticipated at or above target incentive payouts this year (see Figure 4).

Figure 4: Do you expect incentive payouts to be on target in 2022?

It appears that boards and compensation committees continue to consider exercising discretion in determining short-term incentive plan (STIP) payouts in respect of 2021. In fact, 28% of respondent directors expected to apply discretion and of the 28%, 58% anticipated applying upwards discretion and 16% anticipated applying discretion negatively or in a manner that is adverse to participants.

We expect the application of discretion to long-term incentive plans (LTIP) to be more muted as we find that boards and compensation committees are generally more reluctant to modify multi-year performance targets and payouts, and are mindful of the potential for increased shareholder and proxy advisor scrutiny as further discussed below.

Prior to exercising discretion to modify STIP or LTIP targets or determine payouts, boards and compensation committees will want to ensure they have the authority to use such discretion, particularly if discretion is being used to adversely impact participant entitlements. Boards and compensation committees will also want to avoid the use of discretion in one year, which may be viewed as obligating the company to use similar discretion in subsequent years. These objectives can be achieved, in part, through clear and concise plan documentation and employee communications. Companies should review their STIP and LTIP plan documents (including any award agreements) and contractual arrangements with their employees to ensure there is express and unambiguous language that permits the use of discretion for the desired application.

Public companies will want to consider the views and interests of their stakeholders before exercising discretion to modify targets or determine payouts, including the views of institutional investors and proxy advisory firms. Institutional Shareholder Services is generally not supportive of changes to outstanding LTIP awards and will evaluate any changes on a case-by-case basis to determine if appropriate discretion was used and if adequate explanation was provided to shareholders of the rationale for the change. Glass Lewis is also focused on sufficient disclosure and rationales being provided to shareholders in connection with compensation-related changes and will assess the reasonableness of proposed changes by considering if they are consistent and in proportion to the impact on shareholder interests and employees.

Since the Supreme Court of Canada’s decision in BCE Inc. v. 1976 Debentureholders, boards and compensation committees of Canadian companies have become accustomed to considering the interests of multiple stakeholders, including shareholders, employees, creditors, and governments, among others, when exercising their business judgment. Under Canadian law, directors are required to act in the best interests of the company and the company’s interests are determined by reference to the interests of the various stakeholder groups that together comprise the corporate enterprise, and those interests may not always be aligned. While a decision to modify STIP or LTIP targets or payouts could create conflict with the short-term interests of investors, boards and compensation committees need to think holistically and carefully balance the views of investors with the long-term best interests of the company and the need to incentivize and retain their executive team members.

2022 STIP & LTIP Modifications

Nearly one-quarter of directors who participated in the Survey anticipated making design modifications to their incentive programs in the upcoming year and the most common change was adding or removing STIP and LTIP performance metrics. By way of example, we are seeing increased incorporation of ESG (Environment, Social, and Governance) metrics into incentive programs. In fact, 83% of director respondents confirmed that their companies have adopted ESG incentive metrics or foresee adoption in the next year (up from 74% last year) and we are seeing year-over-year increase in focus on ESG-related priorities, such as environmental / sustainability (see Figure 1 above). ESG matters have become an important strategic priority, and boards and compensation committees are being held accountable for their ESG commitments.

Read our article, “Key Priorities for Boards in 2022” for additional commentary regarding ESG and stakeholder engagement.

Any modifications to STIP and LTIP designs, including applicable performance targets, must be clearly drafted and communicated in a timely manner to eligible participants in order to avoid any future conflicts or disputes. Additionally, any such modifications will generally trigger shareholder disclosure obligations in a public company’s annual proxy circular, regardless of whether the amendments require shareholder approval. If the modifications do require shareholder approval, public companies will need to consider the applicable stock exchange requirements.

Companies will need to be mindful of public perception, potential reputational damage and overall scrutiny that could arise from compensation decisions that are perceived as protecting executives’ interests relative to employees and other stakeholders. It will be important for public companies to provide a clear and compelling rationale for any changes being made to their STIP and LTIP designs.

Conclusion

This year will continue to present boards and compensation committees with the challenging task of evaluating their STIP and LTIP programs under the continuing impact of the COVID-19 pandemic. Many companies established their 2021 performance metrics when there was significantly more uncertainty regarding COVID-19. Boards and compensation committees are now re-evaluating whether these metrics are still appropriate, and many are shifting their focus and attention to other priorities, including talent management and retention. While strategies can be implemented to compensate management teams and retain top talent, boards and compensation committees will want to be sure they have taken appropriate measures before implementing decisions related to compensation.

- In Ontario, non-competition obligations in employment agreements (non-compete agreements) are now prohibited (and, if applicable, voided) in employment contracts entered into with a non-“executive” employee after October 25, 2021. For additional details, please see “Ontario passes Working for Workers Act, 2021”.

- The Ontario Court of Appeal’s decision in Waksdale v Swegon North America Inc., 2020 ONCA 391 (“Waksdale”), remains the law in Ontario, and includes the determination that an unenforceable “for cause” termination provision rendered all termination provisions in an employment agreement void, regardless of whether or not the termination provisions are separated within the agreement. For additional details, please see “Court of Appeal rules that unenforceable ‘for cause’ termination clause voids separate ‘with notice’ termination clause”.

- The Supreme Court of Canada’s decision in Matthews v. Ocean Nutrition Canada, 2020 SCC 26 (“Ocean Nutrition”) includes the determination that incentive compensation will normally be payable during the reasonable notice period, absent clear contractual language to the contrary. Exclusionary clauses that seek to limit an employee’s right to incentive compensation will be strictly construed and must be absolutely clear and unambiguous, covering the exact circumstances that have arisen. For additional details, please see “Supreme Court of Canada: Incentive compensation is payable during the reasonable notice period absent clear contractual language to the contrary”.

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Janelle Weed.

© 2025 by Torys LLP.

All rights reserved.