M&A outlook for 2025

The M&A climate in 2025 begins with an optimistic mood on the heels of a significant dealmaking recovery in the second half of 2024 following a period of pandemic-induced disruption. However, a number of variables could bring challenges, including geopolitical tension, trading disputes resulting from the incoming Trump Administration’s threats of tariffs and increased scrutiny of foreign investment from Canadian regulators.

We reflect on Canada’s 2024 deal activity and consider what may be in store for 2025 as acquirors and investors gear up for an active year of dealmaking.

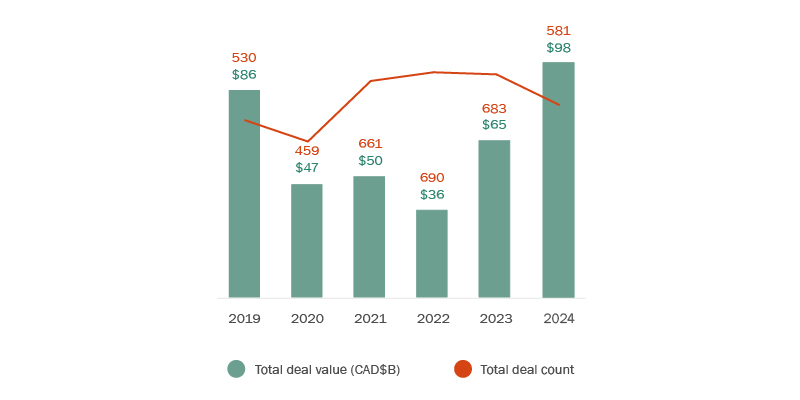

Canadian domestic M&A

In contrast to the previous year, 2024 saw a resurgence in M&A, and there is reason to believe that conditions will be right to continue this trajectory through 2025. Macroeconomic factors and market trends, such as a lower interest rate environment, easing inflation, private equity firms flush with dry powder and the availability of transaction financing on increasingly favourable terms, have been pivotal in encouraging deal activity and making large-scale deals more feasible.

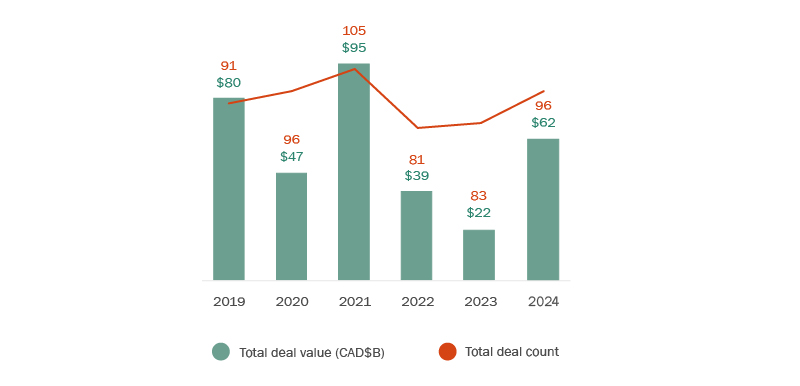

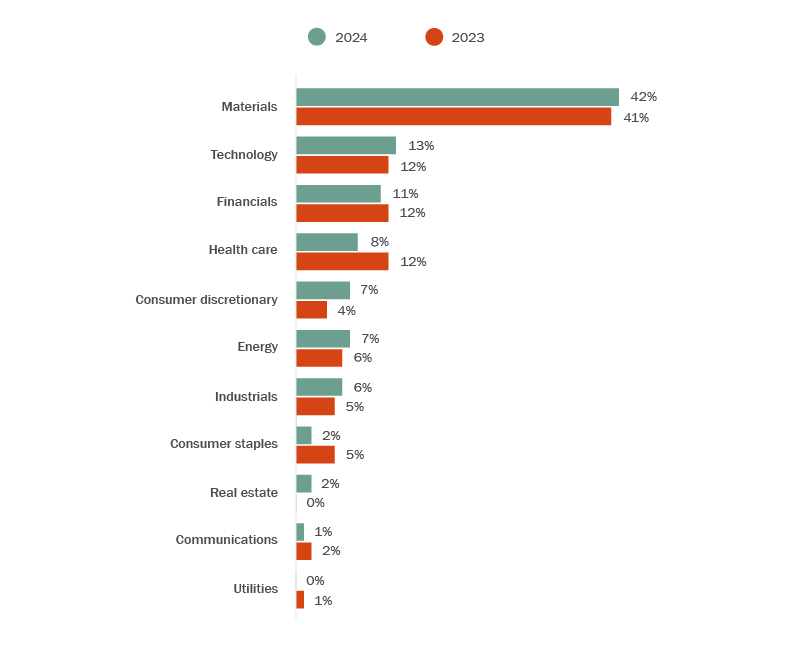

By year’s end, the total domestic public M&A deal value for 2024 was around $63 billion, representing a robust increase from 2023 (see Figure 1). Within this environment, deal sizes have also been notably larger, with more transactions over $1 billion.

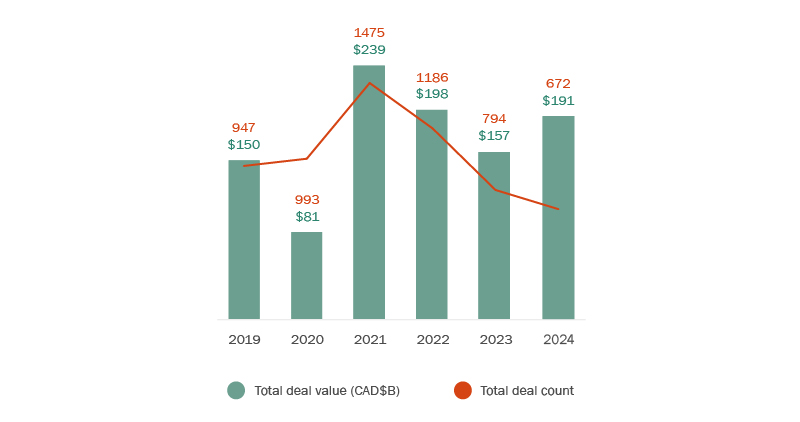

Figure 1: YOY Canadian public M&A by value and volume

Public M&A deal activity ended on a positive note in 2024, with both deal value and deal count showing significant growth compared to the past two years. The resurgence of public M&A activity has fostered market confidence, which we are also seeing mirrored in private M&A deals—a trend we elaborate on below.

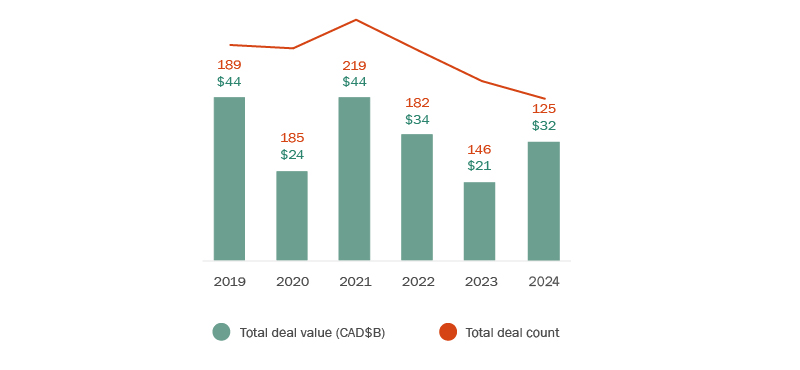

Figure 2: YOY Canadian private M&A by value and volume

The total transaction value for 2024 private M&A deals ($32 billion) surpassed that of 2023, with growth expected to continue into 2025. Additionally, as macroeconomic factors generally become more favourable for dealmaking, more private equity fund exits are anticipated, which could further bolster private M&A activity.

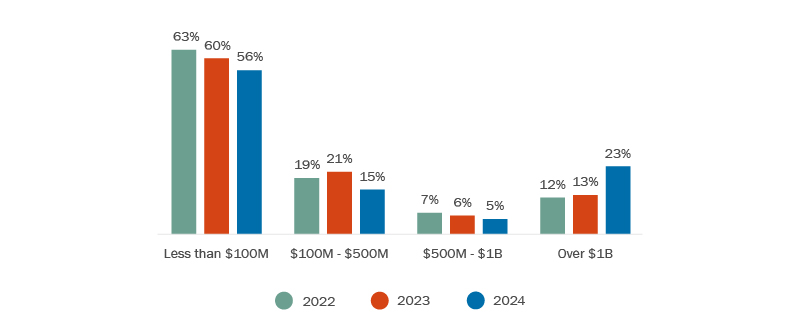

Figure 3: Canadian public M&A by deal value

Overall, deal value saw significant growth in 2024. As is typical of the Canadian market, most deals were in the small- to mid-value deal range, under $100 million (see Figure 3). That said, the number of public M&A deals valued at over $1 billion nearly doubled in 2024 compared to 2023 levels. Similarly, in private M&A, we are seeing an increase in the proportion of deals valued over $1 billion, with 30% of transactions falling into this category.

Sectors in focus

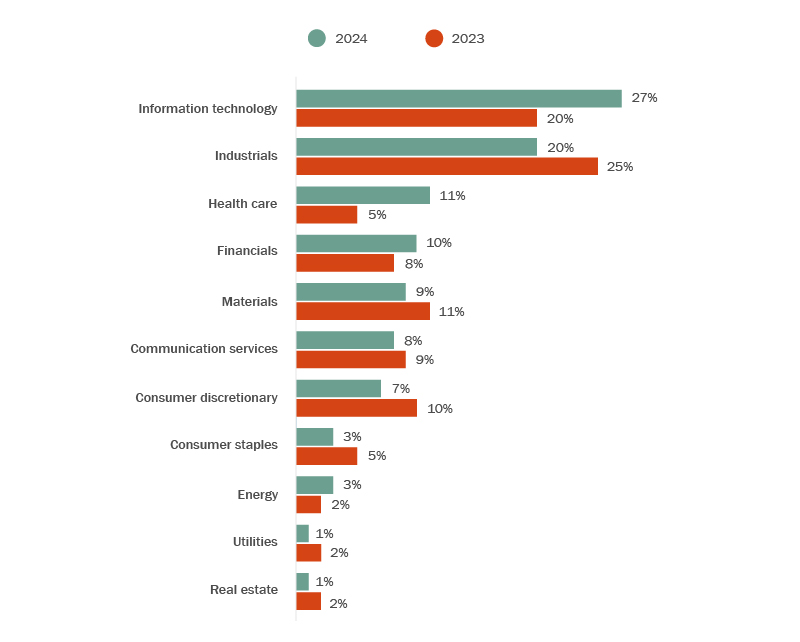

Figure 4: Target industry sector for public M&A

In terms of sector activity, materials remains the leading target sector (as it was the previous year), representing nearly half of all deals in 2024. These included significant mining and metals transactions involving steel, copper, gold, lithium and uranium. We expect continued M&A activity in the mining and metals sector as strategic players seek further critical minerals opportunities to participate in the demand from the energy transition that is underway and accelerating. Canadian companies are well positioned to benefit from this trend given Canada’s leading domestic mineral endowment and the attractive overseas assets held by many Canadian mining companies.

Of note are policy changes under the Investment Canada Act designed to bolster Canadian firms by limiting acquisitions of control of “significant” critical minerals businesses. At the same time, legislative amendments to the Act make it easier for the government to conditionally approve transactions, which will likely lead to fewer acquisitions being blocked.

The momentum in materials is closely followed by technology, as many attractive businesses in this sector overlap significantly with Canada’s battery supply chain initiatives. In addition, investors and pension funds are being encouraged to invest in data centres, AI, and digital infrastructure. The Canadian Sovereign AI Compute Strategy seeks to bolster investment in domestic AI capacity, and additional funds for AI data centre projects were earmarked in the 2024 Fall Economic Statement. Of course, other technology priorities will also be on investors’ radars, as there is sustained interest in acquisitions in cybersecurity, generative AI, and advancing digitization across industries.

The financials sector continues to be a good source of M&A opportunities in Canada, with a healthy mix of institutional investors, strategic buyers and private equity firms looking to bolster their investment in this industry. Larger deals are also driving activity—for example, in June 2024, National Bank of Canada announced the acquisition of Canadian Western Bank, which valued CWB’s equity at $5 billion. At the tail end of 2024, CI Financial Corp. (CI) announced that it entered into a definitive agreement with an affiliate of Mubadala Capital to take CI private in a transaction that values CI’s equity at approximately $4.7 billion and implies an enterprise value of approximately $12.1 billion.

Figure 5: Target industry sector for private M&A

The most active sectors for private M&A by deal volume were information technology (IT) and industrials, with a growing percentage of deals in the IT sector in 2024. Investors continue to prioritize IT, particularly infrastructure software and cybersecurity.

Interestingly, while health care targets saw fewer deals in the public markets (see Figure 4), the sector saw a rise in private deals (see Figure 5). Larger, higher-value transactions in health care have contributed to this uptick, and macroeconomic factors, such as an aging population, add to the long-term stability of this sector.

Amid the rising trend of going-private transactions, private equity, institutional and strategic investors have been finding more attractive public company targets. With private equity's record levels of dry powder, the industry appears poised to seize more opportunities coming out of the public markets this year.

Cross-border transactions

The cross-border aspects of many Canadian businesses appear set for potential challenges in 2025. Geopolitical developments, potential shifts in the U.S. regulatory environment, as well as the across-the-board tariffs proposed by President Trump and other potential changes to U.S. trade policy, will require more creativity from dealmakers as they navigate more complex transactions, which we discuss below.

Inbound M&A

Canadian inbound M&A activity saw significant growth in 2024, and we expect deal flow into Canada to remain strong throughout 2025. The total deal value for 2024 surpassed the total deal value for each year from 2014 to 2023, driven by a surge in high-value deals (see Figure 6).

Figure 6: Foreign buyers of Canadian targets

Canadian inbound M&A in 2024 had the highest number of deals valued at over $5 billion compared to the last 10 years. Despite this increase in deal value, the number of transactions has been depressed compared to the last several years. The proportion of deals falling in the $100 million to $500 million range has declined, accounting for only 16% of total deals in 2024, down from 20% in 2023.

The United States remained the top acquiror of Canadian targets in both deal value and count for 2024. U.S. investors have significantly increased their investment in Canadian companies, with a record deal value level in 2024. Other top acquiror countries by deal count include Australia, followed by the UK and France.

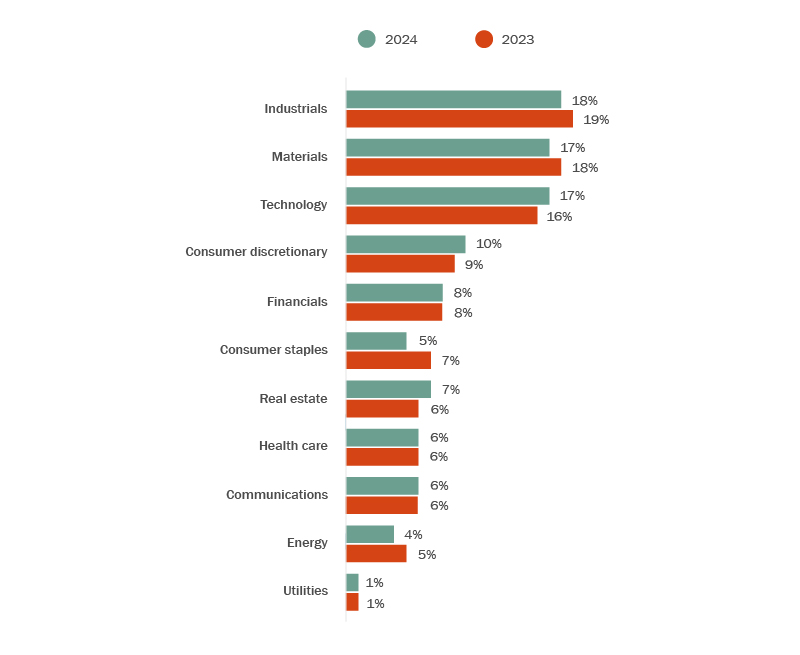

Figure 7: Inbound Canadian target industry breakdown

The top target sectors driving M&A activity into Canada for 2024 were industrials, materials, and technology. By tapping into its mineral wealth and manufacturing power, Canada has attracted significant investment in the battery supply chain for electric vehicles, outperforming China at the beginning of 2024. The Government of Canada has also continued to invest in Canada’s position as a tech hub, and PE funds continue to seek out opportunities in the clean tech and renewables-adjacent sectors.

While robust in terms of total deals, foreign direct investment faces increased scrutiny, particularly for buyers from China. In 2024, amendments and policy changes to the Investment Canada Act provided the government with more tools to review investments under the banner of national security, as well as transactions in the interactive digital media sector. Although there will be a Canadian federal election and a likely change in government this year, the regulatory environment surrounding foreign investment is unlikely to materially change.

Outbound M&A

Canadian outbound M&A activity continues to decline since reaching its peak in 2021, but deal values have begun to rebound; however, it remains unclear how the proposed tariffs on Canadian goods from the U.S. will affect outbound M&A for 2025.

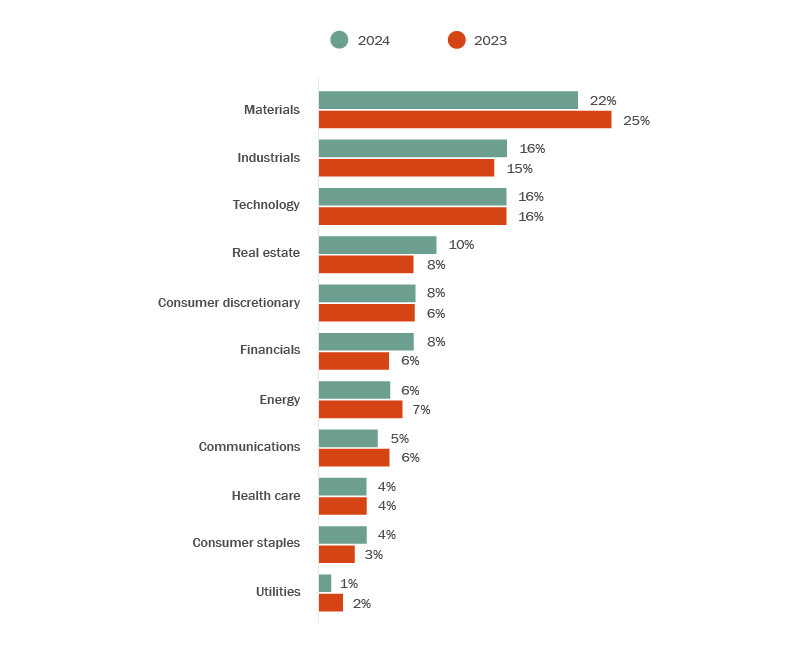

Figure 8: Canadian outbound M&A

The number of Canadian buyers doing outbound deals in 2024 was less than half the record deal count of 1,475 deals announced in 2021. And while the total deal value for 2024 surpassed 2023 levels, it was mainly driven by the value of one deal: the proposed acquisition by Couche-Tard of Japan-based Seven & i Holdings for approximately $90 billion.

For 2024, the top target sectors for Canadian outbound M&A activity are materials, industrials, and technology. Despite being in the top spot, materials saw a decline in deal activity, accounting for only 22% of total deals compared to 25% in 2023 (Figure 9). Japan has emerged as the top destination for Canadian outbound M&A in terms of deal value in 2024. After excluding the Seven & i Holdings Co, Ltd acquisition, the U.S. remains the top destination for Canadian buyers in terms of deal count and deal value, although we saw a decline in Canadian investment into the U.S. in 2024 compared to the prior year, both in terms of deal value and count.

Figure 9: Canadian outbound investment: target industry sector

Conclusion

Notwithstanding the various geopolitical and regulatory headwinds, on balance, the overall Canadian M&A outlook for 2025 is promising, as a lower interest rate environment and other positive macroeconomic factors favour an active deal environment for M&A transactions.

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Janelle Weed.

© 2025 by Torys LLP.

All rights reserved.

Tags

M&A

Transactions

Advisory and Regulatory

Capital Markets

Private Equity and Principal Investors

Buyout Transactions

Private Fund Transactions

Board Advisory and Governance

Financial Services

Fintech

Mining and Metals

Technology

Competition and Foreign Investment Review

Emerging Companies and VC

Banking and Debt Finance

Private Credit