Ontario Long-Term Funds: Ontario’s new proposed access fund model

The Ontario Securities Commission’s (OSC) Consultation Paper 81-737 (the Proposal) proposes a novel framework that could reshape how retail investors (RIs) gain exposure to certain alternative classes of assets. That framework involves the potential creation of a new type of public investment fund referred to as an “Ontario Long-Term Fund” (OLTF).

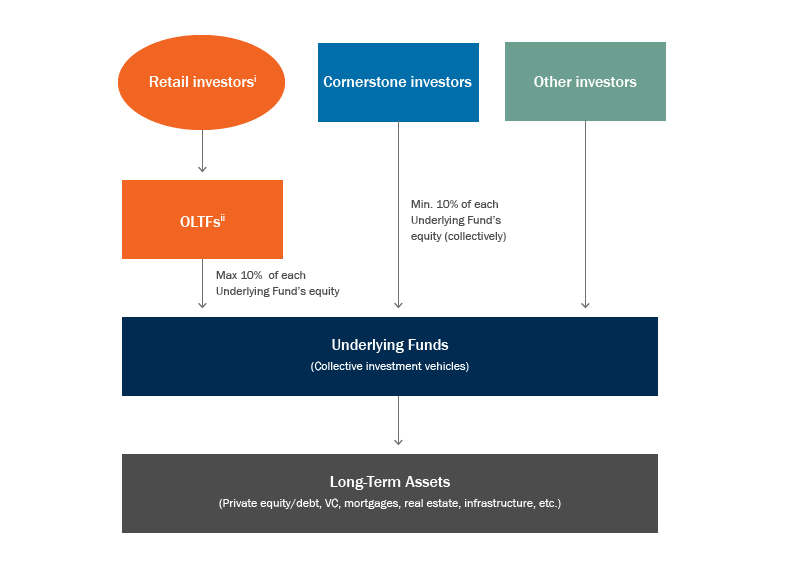

In order to allow retail investors to indirectly benefit from the investment expertise of institutional investors, the OSC proposes to require an OLTF to be structured essentially as an access fund available to the public through a new form of prospectus and intended to invest in private institutional venture capital, private equity, private debt, mortgages, real estate, infrastructure, and natural resource investment funds (the Underlying Funds). While the proposed terms of the OLTF would resemble some of the terms found in the existing private retail access fund market (which is limited to accredited investors), the OSC is currently considering certain terms that deviate from that market. Below are a few examples that would set OLTFs apart.

The proposed OLTF framework

iDistribution: Prospectus-qualified offering (using new prospectus form for OLTFs) through registered dealers and portfolio managers.

iiInvestments in illiquid assets: 50-90% of NAV must be invested in long-term assets through Underlying Funds (potential flexibility to set own liquidity parameters).

Under the Proposal, OLTFs would become reporting issuers in Ontario through a prospectus-qualified offering (using a new prospectus form for OLTFs) and would, therefore, allow the general public to invest in such funds through registered dealers and portfolio managers. Unlike mutual funds or non-redeemable investment funds (NRIFs) that are reporting issuers under the existing regime, OLTFs would be exempt from regulatory caps on illiquid asset holdings. Instead, they would be required to invest a certain percentage of their NAV (the OSC is considering a bracket of 50% to 90%) in long-term assets through Underlying Funds. The OSC is also considering allowing OTLFs to potentially set their own liquidity parameters based on redemption and liquidity needs. OTLFs could be both open-ended or closed-end funds, but the OSC is considering limiting redemption features for open-ended funds to potentially no more frequently than monthly and no less frequently than annually (which is very similar to what we typically see in the private access fund market).

Unique features diverging from the private funds market

While OLTFs would share similarities with private access funds, several features under the Proposal differ from common private fund practices:

- Underlying fund ownership: Amongst the various measures put forward to mitigate risk, the Proposal limits an OLTF’s ownership in any single Underlying Fund to 10% and caps individual asset investments at 10% of NAV for open-ended OLTFs and 20% of NAV for closed-end OLTFs to ensure diversification. See the diagram above for a high-level overview of the Proposal. Under the Proposal, each Underlying Fund must have one or more “Cornerstone Investors” owning collectively at least 10% of its equity. This is to ensure that the retail investors in the OLTFs will benefit from the experience of institutional investors. This means that OLTFs will typically need to be structured as access funds investing in institutional private funds. We hope that the proposed regulation will apply the ownership requirements in a manner that gives flexibility to structure the Underlying Funds through a typical master-feeder structure and perhaps even allow retail dedicated co-investment funds intended to co-invest with an institutional fund. We hope also that the definition of “Cornerstone Investor” will be sufficiently flexible to account for non-Canadian institutional investors (the OSC seems to be considering using the “permitted client” definition of National Instrument 31-103, which would achieve that objective).

- Redemption notice and payment timelines: The Proposal would allow a maximum 30-day redemption notice period for open-ended funds, which is comparable with most private open-ended access funds, though some funds require up to 60 days. However, OLTFs would be required to pay out redemption proceeds within 15 days of the valuation date, significantly shorter than private access fund market norms, where payouts can often take up to 30 days.

- No early redemption discounts: Unlike private funds, which often impose early redemption discounts to manage liquidity and discourage short-term exits, OLTFs would not be permitted to charge early redemption discounts other than a redemption fee to cover the actual costs incurred to administer the redemption.

- Redemption caps and restrictions: The OSC proposes to allow OLTFs to cap redemptions at 10% of NAV annually (or any higher percentage). This would allow sufficient flexibility to match what we typically see in the current private access funds, provided the OSC allows for smaller caps with respect to the shorter redemption periods. One innovation, however, is the requirement to dissolve if annual redemption requests exceed this cap for two consecutive years1. In the private access fund market, such mandatory wind-up provisions are rare and fund managers typically retain broad discretion to suspend redemptions indefinitely when redemption gates apply and when facing liquidity challenges.

- Mandatory corporate structure: The OSC mentions that it is considering requiring OLTFs to be structured as a corporation and have an independent board of directors. As an alternative, the Proposal considers allowing OLTFs to establish an independent review committee (IRC) vested with enhanced supervisory powers beyond reviewing conflict-of-interests. Given that private fund sponsors typically select fund structures based on tax considerations, we hope the OSC will elect to choose the IRC approach.

Stay tuned

Overall, the OLTF Proposal represents a positive step toward modernizing Canada’s investment fund market by allowing non-accredited investors to access traditionally restricted asset classes. Although OLTF units would only be distributed to Ontario investors if the Proposal is implemented, we are eager to see whether other Canadian provinces follow suit and adopt similar frameworks, fostering broader investment opportunities for RIs across the country.

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Janelle Weed.

© 2025 by Torys LLP.

All rights reserved.