Recent trends in U.S. private funds

As institutional investors and fund sponsors endure the ongoing slowdown in exit activity and its effect on fundraising and liquidity, we have observed the following trends and opportunities in the U.S. private funds market.

1. Fundraising

The U.S. private funds market continues to experience a slowdown in portfolio company exits, which has made it more difficult for sponsors to return distributions to investors, who in turn have less available capital to commit to new funds. The ability to deploy new capital has been particularly difficult for certain institutional investors that are subject to asset allocation targets, as many continue to remain overweighted in the private markets. This phenomenon is referred to in the market as the “numerator effect” (standing in contrast to the “denominator effect” felt in 2022 after investors found themselves overweighted to private equity following the decline in their exposure to public market securities).

According to PitchBook’s Global Private Market Fundraising Report1, the fundraising challenges have not been felt evenly among all asset classes, resulting in the following breakdown:

- Private equity has remained steady from a fundraising perspective. Particularly in the U.S., private equity fundraising accounts for the largest market share in 2024, representing approximately 50% of the market.

- As in 2023, secondaries remain a popular asset class (which is unsurprising given the difficulty finding exit routes, as investors are looking to find liquidity relative to their holdings and sponsors are looking to find liquidity through continuation vehicles) and represent the second largest in the market at approximately 11%.

- Venture capital fundraising has observed a persistent slow-down, now representing approximately half of what it had represented in the market in 2022.

- Funds focused on private debt, real estate and real assets have generally experienced a lull in 2024 but have not departed materially from their historic market share.

- Funds of US$1 billion or larger have fared better in this challenging fundraising market relative to mid-size, smaller and newer funds, as investors have more readily flocked to established, well-known sponsors and larger funds, with such funds representing approximately 80% of fundraising figures in the first quarter of 2024.

Despite this, investors remain committed to private markets and activity seems to have experienced an uptick in the second half of 2024 as institutional investors work to maintain and, in some cases, increase allocations.

2. Retail investing

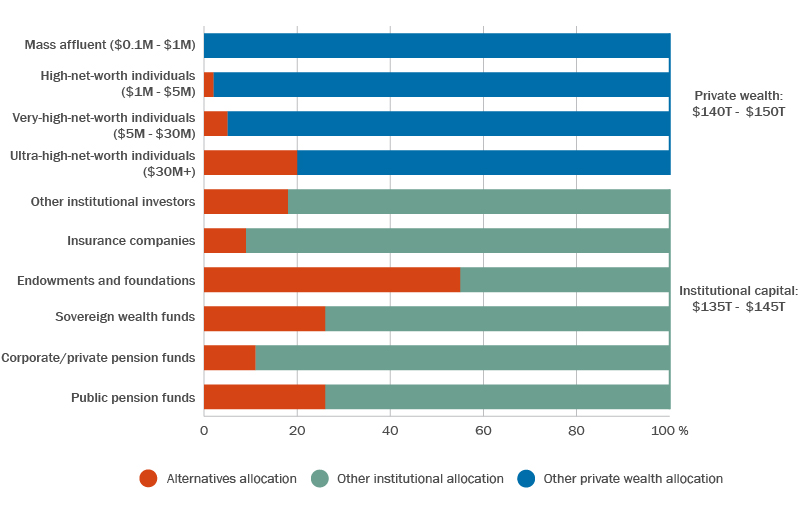

Given the challenging fundraising market, some fund sponsors are beginning to set their sights on a largely untapped source of additional capital—retail investors (i.e., high-net-worth individuals and family offices). According to Bain & Company (see Figure 1), retail investors hold approximately 50% of global assets under management but represent less than 20% of assets under management held by private funds.

The interest is mutual, as retail investors are similarly looking for ways to participate in private funds, which can offer more attractive returns relative to the public markets and provide greater diversification.

A separate group, composed of various intermediaries (such as banks, financial advisers and digital platforms) that sit between fund sponsors and retail investors also has skin in the game, as they see the potential for a substantial new stream of fee income linked to an expansion of retail investors’ participation in the private markets.

Figure 1: Global wealth by investor type, 2022

The growing interest in retail investing is benefiting from a number of recent advances in regulation, innovation and technology that are lowering the hurdles that have generally blocked broader participation. Certain regulators are showing signs of a willingness to expand access to the private markets. For example, in the U.S., the Securities and Exchange Commission recently amended its definition of “accredited investor” to include individuals with sufficient investment “knowledge and expertise” (e.g., an individual with professional certifications, designations or credentials) who may not otherwise satisfy the existing wealth-based criteria. In addition, sponsors are using innovative fund structures that comply with existing applicable regulations but are available to more of the retail market. At the same time, improvements in technology largely being driven by fintech firms, including user-friendly digital platforms, are making it easier and cheaper to facilitate retail participation.

The largest fund sponsors are generally leading the push into the retail space given they have the most resources at their disposal, with many developing new products that are geared specifically for retail investors by offering greater liquidity. For institutional investors, a potential concern could be sponsors seeking greater flexibility to allocate on-strategy investments to retail vehicles over institutional vehicles, as well as an overall reduction in co-investment opportunities if there is a surplus of capital available to close deals.

3. Continuation vehicles

Traditional investment exit routes remain limited and, as such, we continue to see an uptick in creative and longer-term structures to increase exposure to portfolio companies. GP-led secondary transactions or continuation funds, which are liquidation transactions by a sponsor that enable the sponsor to continue to manage a portfolio investment or group of portfolio investments, have remained a popular construct, as well as an ongoing topic of conversation in the market. Continuation funds were historically viewed as a means of transferring unrealized investments out of a fund’s portfolio near the end of its term (often implying the sponsor’s or the fund’s distress), but now they are viewed as a means of extracting additional value from well-performing investments or a means of giving the sponsor more time to develop an asset with an influx of new capital.

In connection with the formation of a continuation fund, the sponsor transfers one or more portfolio companies from its existing fund to a new special purpose vehicle, and the existing fund investors are given the option to reinvest the proceeds from—or roll their interest in the relevant portfolio companies into—the continuation fund or to otherwise receive a cash distribution in respect of their interest in the continuation fund (and such a cash component is funded by new investors in the continuation fund). Often there is a new commitment associated with rolling interests to be considered. Sponsors may look to bake preapproval of a GP-led secondary into their fund documents and, on execution of the continuation vehicle, will look to reset fees and carry paid by, at a minimum, new investors in the vehicle. Investors, for their part, are hesitant to preapprove any such transactions and will look for both an advance Limited Partner Advisory Committee consent requirement, as well as the provision of a fairness or valuation opinion relative to the pricing on the transaction.

While GP-led secondary transactions continue to gain traction in the marketplace, they require careful consideration from both the sponsor and the investor side and can benefit all parties involved when done properly.

4. NAV facilities

As institutional investors and fund sponsors continue to navigate the slowdown in exit activity, net asset value based credit facilities (NAV facilities) are proving to be a useful liquidity solution and are starting to become more mainstream in the market. Unlike subscription line facilities, which are secured by investors’ unfunded commitments and intended to be used as a cash management tool to smooth out capital calls, NAV facilities are secured by the value of a fund’s underlying assets and can be used for a variety of purposes, including to pursue growth opportunities and follow-on investments, support distressed portfolio companies and facilitate early distributions to investors.

Despite their rapidly rising popularity, NAV facilities remain a novel concept for many fund investors. Generally speaking, sponsors willing to take the time to communicate with investors regarding their intentions for using NAV facilities, why they may be a better solution than other liquidity options, and what the proceeds will be used for, are having greater success getting investors comfortable with the enhanced borrowing flexibility. Investors also typically expect to see some parameters in the partnership agreement around when the NAV facility can be used (e.g., after the fund has deployed substantially all of its unfunded commitments), how much can be borrowed under the NAV facility (e.g., as a percentage of aggregate NAV) and for what purpose the borrowed amounts can be utilized.

In particular, the question of whether sponsors should be permitted to use NAV facilities in order to make early distributions to investors (and/or to pay themselves carried interest) remains a controversial topic in fund negotiations, as investors typically seek to prohibit this practice due to concerns around the cost associated with such early distributions (i.e., significant interest expenses that will ultimately eat into their returns), unnecessary risk being put on the fund’s portfolio and the possibility of sponsors seeking to use the flexibility to boost their performance metrics.

5. SEC rules vacated

On August 23, 2023, the Securities and Exchange Commission (the SEC) released final rules under the Investment Advisers Act of 1940 (the Advisers Act), focused on private fund disclosures and sponsor practices (the Final Rules). According to the SEC, the Final Rules were designed to protect investors in private funds and prevent fraud, deception, or manipulation by investment advisers. Shortly following their adoption, the Final Rules were challenged by six associations representing private fund managers (the Private Fund Managers) in the United States Court of Appeals for the Fifth Circuit (the Fifth Circuit). On June 5, 2024, the Fifth Circuit vacated the Final Rules in their entirety based on the court’s determination that the SEC did not have statutory authority under the Advisers Act to formulate the Final Rules. As such, the court never ruled on the substance of the Final Rules themselves.

The market will be watching the SEC to see whether they appeal the ruling. To date, there is no indication that they intend to do so.

- PitchBook, Q1 2024 Global Private Market Fundraising Report (2024), https://pitchbook.com/news/reports/q1-2024-global-private-market-fundraising-report.

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Janelle Weed.

© 2025 by Torys LLP.

All rights reserved.