Authors

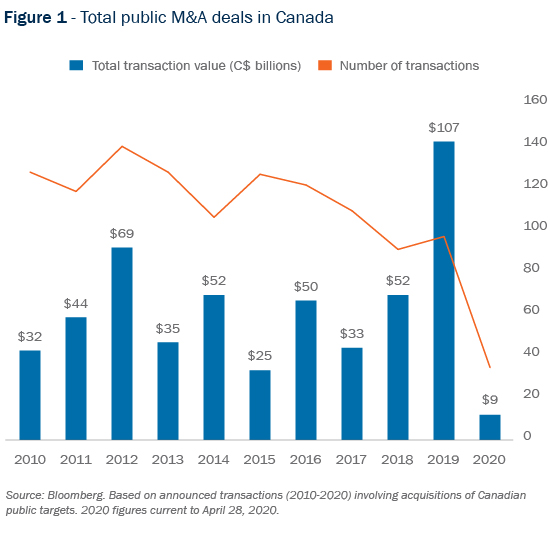

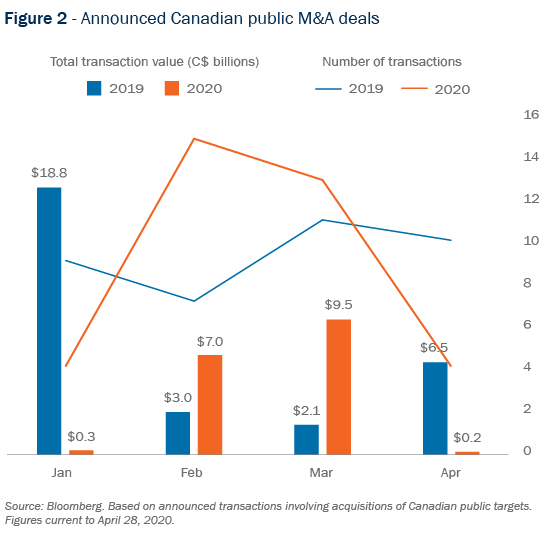

Business leaders across the globe have focused foremost on continuity concerns amid the COVID-19 crisis. In this environment, M&A activity in Canada, along with the rest of the world, has unsurprisingly experienced a decline (see figures 1 and 2).

Despite the stalling of many transactions as the world continues to respond to the pandemic, some sales processes have continued to forge ahead, and we anticipate more transactions will follow in the coming months.

Along with an overview of the impact the coronavirus pandemic has had on dealmaking, we discuss considerations to bear in mind while repositioning M&A strategy for new realities companies will face during, and on the other side of, the crisis.

Impact on public M&A

Since the start of the crisis, we have seen many M&A transactions paused or abandoned, while a few transactions—particularly in industries less affected by the pandemic—have pressed forward, including through auction processes (figures 1 and 2).

Of course, shelter-in-place restrictions have thrown a wrench into many of these processes, disrupting on-site due diligence visits and making pre-existing relationships and industry/sector expertise a competitive strength. Even financial modelling has been challenged as existing appraisals are set aside and traditional assumptions must be revisited.

It is expected that, in recovery, we will see a rise in M&A activity, whether from opportunistic buyers, or from sellers or target companies looking to potential buyers as sources of financial support, or in response to shareholder activism.

The COVID-19 crisis has had deep repercussions in the public markets, with market volatility causing many public companies to experience significant declines in their valuations. For potential public targets, depressed valuations may spur hostile bid activity as buyer and seller price expectations diverge. These conditions may test Canada’s takeover bid regime, which was amended a number of years ago to enable target boards to slow a hostile bidder.

We may also see activist shareholders taking action in recovery, disrupting publicly announced transactions, agitating for an M&A transaction in this uncertain environment, or building significant stakes in vulnerable companies.

Target board preparedness

Now more than ever, target boards should be attuned to their shareholders and proactively engage with them, including seeking feedback from institutional and other long-term shareholders on their future operating plans. In so doing, issuers will need to be mindful of their public company disclosure obligations (see our detailed guidance “Preparing for your next earnings call in the midst of a pandemic”).

Target boards should equally stay vigilant on matters that remain of ongoing importance to shareholders, such as management performance, executive compensation, accountability, and corporate efficiency.

A public company board should revisit its takeover bid and activist preparedness plan with its advisers to ensure it is equipped to effectively respond to an unsolicited acquisition approach or activist campaign (read our comprehensive article on COVID-19 M&A considerations here).

An increasing number of widely held U.S. public companies have recently adopted shareholder rights plans (also known as “poison pills”) to protect against opportunistic investors in light of declining stock prices in the current environment. Although rights plans are viewed as a more effective defensive tactic in the U.S than in Canada, Canadian target boards should also consider whether to adopt a rights plan in the current environment in order to regulate exempt purchases of target securities through creeping acquisitions and private agreement purchases, and prevent irrevocable lock-up agreements.

Proxy advisory firms have issued guidance on the adoption of these plans (for details, see our note “COVID-19 guidance from proxy advisory firms”). This guidance will have less relevance to Canadian issuers in light of the different regulatory approach to shareholder rights plans in Canada.

|

Listen to Torys Business Brief for more on post-recovery M&A. |

Rise in PIPE transactions and debt lines

Private investments in public equity (PIPE) transactions have gained momentum this year (read more on PIPEs and other capital-raising options for public companies here). This trend is expected to continue, driven by a number of factors, including public companies seeking access to capital to finance operating plans, and industry players and financial investors looking to obtain strategic ownership stakes at attractive prices.

Some traditional equity buyers may become lenders in the coming months, with alternative financing being sought by businesses in search of a lifeline beyond their traditional debt facilities. These financings may be loan-to-own opportunities depending on how long the pandemic continues and how robust the recovery.

Consolidation activity

Widespread disruption of normal business operations has resulted in distressed public company valuations—and this will likely spur consolidation activity in the coming months. Currently competing businesses will look to combine their operations in order to survive the crisis and re-focus their longer-term strategies, with consolidation activity anticipated in severely disrupted sectors such as oil and gas, hospitality, retail and travel.

Some M&A activity will be supported by governments seeking to help businesses in ailing sectors stay afloat. In some cases, this desire for consolidation will have to be balanced against potentially challenging regulatory requirements and policy concerns

Cross-border M&A in recovery

Increased scrutiny of foreign investment

M&A activity is likely to be cross-border, with low valuations and, in the case of Canada, a weak dollar, creating a favourable acquisition environment for foreign investors. In these circumstances, governments in Canada and the U.S. are expected to be alert to opportunistic behaviour and broaden the focus of national security reviews.

Pre-crisis, governments frequently limited foreign investment interventions to transactions in the IT sector or defence production chain. That focus will shift to include transactions affecting the food supply chain, health care industry and other essential consumer products and services.

The Canadian government has already announced that it will “scrutinize with particular attention…foreign direct investments of any value, controlling or non-controlling, in Canadian businesses that are related to public health or involved in the supply of critical goods and services to Canadians or to the Government.” Particular focus will be given to state-owned or state-influenced investors.

Similarly, the U.S. government has warned contractors against accepting “adversarial capital,” while observing that the review process conducted by the Committee on Foreign Investment in the United States (CFIUS) is “more important than ever.”

Although these responses are focused and may be time-limited, a protectionist wave in response to the pandemic may form part of a broader global trend emerging, which may have a chilling effect for outbound investment activity worldwide.

Increasingly complex antitrust reviews

Many North American transactions will also be subject to antitrust reviews in Canada and the U.S. To date there appears to be little change in how agencies are handling merger reviews. However, their task will become more challenging as COVID-19-related M&A activity picks up.

That is in part because agencies typically rely on historic market share and other data to predict the future competitive impact of business combinations. In a COVID-19 environment, current or past data may give little indication of future outcomes.

The challenge of assessing mergers in this environment will be compounded by numerous other factors. For example, agencies may be required to make complex economic assessments of whether target firms are failing or whether efficiencies created by a combination ought to justify its approval. In some sectors, governments may step in to regulate, encourage consolidation or, in some cases, take over businesses.

The rapid deterioration of some businesses will mean that some merger assessments will need to be quick. That may not come easily for competition agencies, who typically make merger assessments based on large amounts of data after lengthy reviews. To their credit, the U.S. antitrust agencies have committed to respond expeditiously to all COVID-19 requests and particularly to collaborative activities among competitors in the public health and safety sectors.

These developments in foreign investment review and antitrust highlight that businesses will be well advised to:

- assess regulatory risk early in the transaction planning process, as this will help inform transaction timelines and regulatory risk allocation;

- build a deal team of advisors with the necessary economic, security or other expertise—a jump-start on the substantive analysis will help with risk assessment and could lead to quicker reviews;

- structure negotiated transactions to minimize concern and satisfy review criteria, such as carving sensitive assets out of the deal; and

- adopt government and stakeholder-relations strategies from the outset. Failure to do so may impinge on deal success.

Private equity/pension fund focus

Private equity and pension fund investors with access to capital will be especially well positioned to take advantage of the post-pandemic market dislocations to pursue opportunistic buyouts and, as discussed above, minority investments in public companies.

Private equity sponsors, in particular, have been sitting on record levels of dry powder. In addition, many sponsors have brought new funds to market during the lockdown period of the pandemic, including funds specifically focused on distressed assets.

In addition, in an environment where access to liquidity will likely remain paramount for businesses, some strategic buyers may remain on the sidelines, reducing competition for attractive assets in favour of private equity and pension fund investors.

While buying opportunities should be plentiful in the coming months, not least because of an anticipated rise in sales of non-core operations to raise capital, it may take some time for buyer and seller pricing expectations to realign, and there may well be some lag before a more steady flow of transactions begins to materialize. In the interim, we may see more transactions with earn-out provisions as way to bridge these pricing gaps.

Conclusion

There is no question that confronting M&A in a disrupted economy will not be easy—there is no playbook to guide dealmakers through the next stage of recovery. Preparing well and remaining agile will be more important than ever to find opportunities and get deals done.

Subscribe and stay informed

Stay in the know. Get the latest commentary, updates and insights for business from Torys.

Stay in the know. Get the latest commentary, updates and insights for business from Torys.

Subscribe Now