Cautious optimism is the consensus view of the private equity and pension fund leaders we canvassed for our private equity report this year. Many believe 2024 could transition the private markets to improved conditions for dealmaking—particularly in the latter half of the year.

PE Pulse 2024 includes commentary from both Torys’ Private Equity Practice and industry leaders on the current state of the market—and what may transpire as the year progresses. Read our predictions and insight on direct investing, fundraising, secondary transactions and the emerging market for GP stakes investments in Canada.

This report captures sentiment in the private equity community at a time of transition.

The past few years put pressure on core areas of the business, with macroeconomic headwinds restricting both dealmaking and fundraising. Elevated interest rates topped the list of challenges, raising the cost of capital and contributing to a widening buyer-seller gap around valuations. On the portfolio side of the business, the increased cost of debt hindered investments in portfolio assets.

Research conducted to support PE Pulse 2024 suggests this year could be different.

What stands out most about the conversations we had with 20+ industry leaders is the element of transition. Where last year’s study indicated reduced optimism from previous years, the responses we received in December 2023 and January 2024 generally expressed cautious optimism. Deal pipelines may not progress until Q3. Yet the consensus of respondents in our research suggests increased movement in the markets this year.

Some recent trends are well positioned to last even as the landscape changes. Secondary transactions have grown as a solution to liquidity challenges during the recent downturn. Yet the future looks bright for secondaries: as institutional investors continue to hone their investment strategies, the market will continue to build momentum in the coming years.

GP stakes transactions—also discussed in this report—represent another area of change in private equity investing. Already well developed south of the border, they are expected to gain further traction in Canada in the coming years.

As private equity leaders prepare for a year of potential transition, success will depend on part on a time-honoured tactic: staying disciplined and patient to align with core investment strategy.

We would like to thank all those who shared their time and insight to create this report. More than 20 private equity and pension fund leaders participated, providing invaluable commentary on today’s market. Several participating organizations requested anonymity; others are listed below.

AlpInvest Partners. BMO Capital Partners. Clairvest. DW Healthcare Partners. Imperial Capital. Maverix Private Equity. New 2ND Capital. Northleaf Capital Partners. ONCAP. Onex Partners. Ontario Teachers’ Pension Plan. OPTrust. Peloton Capital Management. Sagard Private Equity Canada. TorQuest Partners. Vertu Capital. Wittington Investments.

While the macroeconomic headwinds faced by private equity investors in 2023 have persisted into 2024, many industry leaders are cautiously optimistic that improved dealmaking conditions and a more robust market for buyout transactions will emerge during the second half of the year.

“There has to be an event that opens the floodgates for deals—perhaps interest rate flattening or declining debt or something similar—and that could serve as an inflection point for the market”, says Aly Champsi, Managing Director at DW Healthcare Partners.

Creative transaction design, sound resource allocation, and leveraging key relationships: all will be key to success in the year ahead. We expect that special attention will be given this year to businesses that are resilient to economic cycles and those related to energy transition.

In developing this outlook, we connected with leaders across the private equity industry to understand their challenges and opportunities in the coming year.

All of the private equity leaders with whom we spoke highlighted the cost of debt as an area of continued concern for dealmaking prospects in 2024. Our current elevated interest rate environment has increased the cost of capital, in turn contributing to the now well-understood gap between the valuation expectations of buyers and sellers.

“One of our key objectives is to accurately assess the impact of an economic downturn on new and existing investments”, says Edmund Kim, Managing Director at ONCAP. “The high interest rate environment and tight labour market continue to be issues to watch in 2024”.

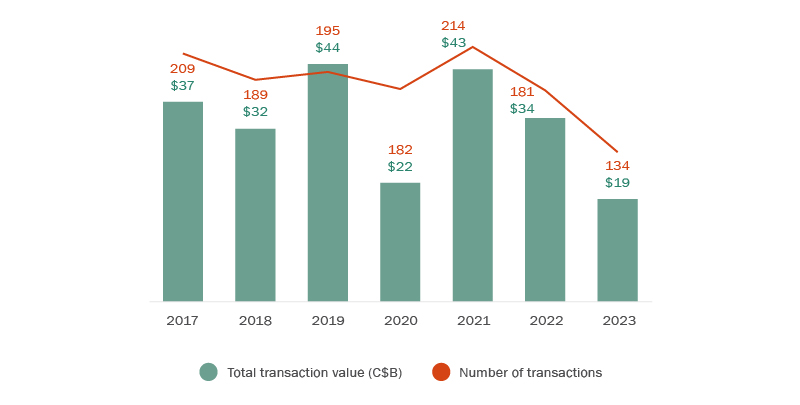

This gap in expectations is seen as the primary reason for the downturn in deal volume and deal value in 2023. Total deal value in Canada declined by more than 40% from 2022 to $19 billion, and deal volume declined by more than a quarter (26%) to 134 transactions.

However, many observed that by the end of 2023 the valuation gap was narrowing and expect that it will continue to close during 2024. With a now approximately 18-month period of muted transaction activity, business owners desiring liquidity may be more willing to entertain lower multiples than those paid during the low-interest era, and it may coax private equity sponsors with considerable dry powder on hand from the sidelines.

As Justin MacCormack, Managing Partner at Imperial Capital, explains: “Market participants with dry powder will be able to take advantage of situations where capital or liquidity is required, potentially resulting in better valuations for any new acquisition”.

There are also encouraging signs that interest rates will stabilize, and perhaps even be cut, in the second half of the year. It is thought that interest rate stabilization will instill confidence in market participants, reduce uncertainty and go a long way towards further bridging the valuation gap. Incidentally, the valuation gap has proven to be far less severe when dealing with top-tier, high-quality assets, which have continued to trade at rich multiples.

Some sponsors observe that it is increasingly difficult to reliably forecast a business’s near-term performance using conventional means, which might involve developing an outlook on the basis of a business’s trailing 12- or 24-month performance. Given where we stand today, the data that has historically been the most relevant for forecasting and budgeting purposes will have been generated during a highly anomalous period of history, which was marred by, among other factors, the COVID-19 pandemic, severe supply chain disruption and skewed customer demand in certain sectors.

Data from this period is inherently limited in its ability to accurately project the future performance of a business. This phenomenon has made it increasingly difficult to value businesses and manage risk, and may also make portfolio company business planning and budgeting challenging in the near term.

For sponsors, remaining disciplined, patient and analytically rigorous will be key in 2024 and beyond.

“Staying disciplined and focused on core strategy will be a key success factor this year”, says Lisa Melchior, Founder & Managing Partner, Vertu Capital. “Sponsors should avoid being distracted by opportunities outside of their core strategy”.

The current macroeconomic environment creates opportunities for sponsors who are willing to be creative and develop bespoke capital solutions for high-quality businesses dealing with challenging circumstances.

“One of the biggest opportunities in 2024 for sponsors,” says Michael Hollend, Partner, TorQuest, “will involve using capital as a solution for companies who need to shore up their balance sheet and deal with the high cost of borrowing but whose shareholders are not yet ready to sell their business.”

For a company approaching debt maturity, or for business owners looking for partial liquidity without having to market the entire business in current conditions, there may be transactions to be had with private equity in the form of preferred share or convertible debt instruments with yield entitlements that can be paid-in-kind, acquisitions of non-controlling interests or other structured equity solutions.

We anticipate an increase in structured equity transactions this year, and sponsors willing and able to think outside of the box stand to benefit most.

Opinions on the distressed market are mixed. While there is acknowledgment that the pressures on leveraged businesses from higher debt costs may result in an increase to the number of opportunities that come to market through insolvency proceedings, some dealmakers are skeptical that higher quality assets will follow this path. For these assets, it is thought by some that their current owners are more likely to find other solutions to capitalization issues than exiting outright at a discounted price.

Sponsors also intend to double down on value creation activities at their portfolio companies in 2024.

“Value creation activities at existing portfolio companies will be top-of-mind for investors in 2024”, says Mohit Talwar, Partner, Maverix Private Equity. “We should see a renewed focus on revenue growth, M&A, and exit activity”.

Tuck-in acquisitions, scaling and improving operations by attracting and retaining high- quality talent, improving working capital efficiency and cutting costs are expected to be priorities.

AI will present both new opportunities and challenges across the full spectrum of sponsors’ business interests and may offer ways to improve productivity and reduce labour costs within the portfolio.

“One of the key factors to our success in the middle market in North America is the work done by the GPs managing our portfolio companies”, says Evert Vink, Partner, New 2ND Capital. “This requires us to continue be focused on alignment with these GPs, and make sure that they are focused on value creation and exit opportunities”.

Healthcare, financial services, consumer services, software and other businesses that are by nature resilient during recessions are thought by some to be especially attractive this year. The energy transition was also highlighted by several leaders as a key investment theme for the year ahead.

In many ways the current economic conditions may dictate industries of focus this year, says Marie-Claude Boisvert, Partner & Head of Sagard Private Equity Canada.

“Recent challenging market conditions and decreased cash flow visibility highlight the importance of a focused and disciplined approach to capital deployment both from a purchase price and leverage standpoint”, she says. “It is prudent to focus on pipeline companies operating in resilient industries with strong management teams and defensible business models”.

The picture of the direct market that emerges from the private equity leaders that we surveyed is largely one of cautious optimism. The macroeconomic situation remains challenging, but 2024 could be a year of transition: one in which the interest rate hiking cycle moderates, the bid-ask spread closes further and transaction opportunities that have been shelved come to market.

In the meantime, sponsors will continue to put capital to work across a wider range of transaction structures and find ways to create value in their portfolios.

“So much of success can be attributed to leaders taking ownership of getting the right people focused on the right things”, says Ken Rotman, CEO and Managing Director, Clairvest. “It sounds so simple. Pulling it off, however, touches all aspects of business and requires a dispassionate view of your people, performance, position, competition, customer sentiment and macro environment. It also requires strong systems to bolster a ‘trust but verify’ approach as complexity and scale grow. Where we stumbled and excelled in 2023 can be traced, in part, to this”.

Being successful during this period will require sponsors to think about opportunities creatively and to allocate resources—financial and human—strategically.

Strong lender relationships will be important this year, both to winning new opportunities and to managing short-term capital-related issues in the portfolio, since during periods of market uncertainty lenders tend to allocate their capital more judiciously and with a preference given to key clients.

“Our partnerships will be critical this year”, says Aaron Toporowski, Managing Director at BMO Capital Partners. “It starts with the private equity sponsors, law firms and accounting firms on originating and executing deals. Also syndicate partners—everyone needs to work well together within the ecosystem”.

As investors and fund sponsors ramp up their investment strategies for 2024, several significant developments are making an impact on the private funds market.

Private equity leaders we canvassed for this report remain concerned about the fundraising climate in the coming year.

“What our industry most needs this year is abundant opportunity for PE exits”, says Jane Segal, Managing Director at Wittington Investments, “supported by a flourishing IPO market and a healthy economy”.

One of the key trends raised in our conversations is the slow pace of distributions from existing funds to investors, which continue to stagnate due to delayed portfolio company exits. For investors who utilize distributions for future investments, this means less capital to commit to newly raised funds and a resulting slowdown in the fundraising market.

Whether or not distributions pick up in 2024 will largely depend on how quickly the valuation gap narrows between buyers and sellers leading to an increase in exits. Many in the industry expect that to happen later this year, perhaps in Q3.

“With the bid-ask not lining up last year”, says Mike Murray, Managing Partner at Peloton Capital Management, “lots of PE sponsors were holding onto assets. That is expected to change in 2024. With interest rates stabilizing and sponsors needing to return capital to investors, the bid-ask spread should close and help spur increased M&A activity”.

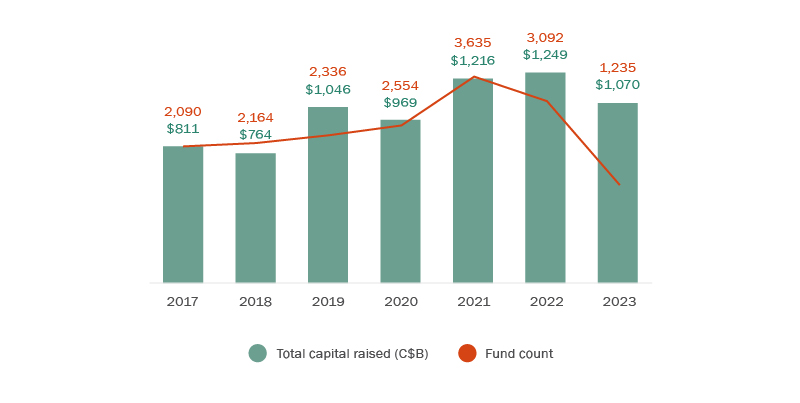

The fundraising numbers from last year lend credence to some of these concerns, with total capital raised down 14% from 2022 and the number of funds down 60%, from 3,092 funds in 2022 to 1,235 in 2023.

One fundraising bright spot came courtesy of secondaries funds. Based on research from PitchBook to the end of Q3 2023, capital raised for secondaries funds grew by more than half (57%) over the prior year period. Regarding LP-led secondaries, sponsors with focused secondaries strategies are well-positioned to engage with investors in need of liquidity. On the GP-led side of the market, these deals solve several common pain points—such as making capital available to portfolio companies while extending the hold period for certain investments.

|

Strategy |

Capital raised (US$B) |

YoY change |

|

Private equity |

$510.4 |

-6.5% |

|

Venture capital |

$170.2 |

-53.5% |

|

Real estate |

$134.9 |

-8.9% |

|

Real assets |

$24.9 |

-85.6% |

|

Debt |

$201.8 |

-24.4% |

|

Fund of funds |

$38.7 |

-24.1% |

|

Secondaries |

$83.1 |

57.2% |

|

Private capital |

$1,164.0 |

-27.4% |

With GPs facing a constricted fundraising climate and pricier debt financing, they are more often approaching their LP base (and sometimes venturing outside their LP base) for co-investment dollars to fill up the equity portion of the purchase price on deals.

LPs have been the beneficiary and, despite overall more anemic deal flow, are receiving a good amount of co-investment opportunities to assess. Yet despite the resulting, somewhat more competitive environment for GPs to raise co-investment dollars, deal terms have not perceptibly changed in LPs’ favour.

In August the Securities and Exchange Commission announced the adoption of its final rules under the Investment Advisers Act of 1940 (the Advisers Act), designed to increase investor protection and transparency. This followed an extensive feedback process that lasted about a year and a half. Certain of the final rules apply only to investment advisers registered under the Advisers Act, while others apply to both registered and unregistered advisers. However, the final rules will generally not apply to non-U.S. domiciled funds advised by non-U.S. advisers.

Although the final rules are largely focused on private fund disclosures and sponsor practices (and therefore do not impose any direct obligations on investors), it will be important for investors to be aware of the change in the landscape, including in connection with their negotiations with sponsors. For example, under the new preferential treatment rule, advisers will generally be prohibited from providing preferential redemption terms to an investor, or providing certain information about portfolio holdings or exposures to an investor, if the adviser reasonably expects it to have a material, negative effect on other investors in the fund.

While it is generally expected that these prohibitions will be viewed narrowly in the context of open-ended funds, there is generally thought to be some ambiguity in the language that will need to be fleshed out. However, other than these two prohibitions, advisers will continue to be permitted to provide any other preferential rights to an investor (including material economic terms, such as liquidity rights, fee breaks and co-investment rights—which must be disclosed in advance to other investors), so long as such rights are disclosed.

Also, under the new restricted activities rule, advisers will be restricted from engaging in certain activities unless disclosure is provided to investors and, in certain cases, consents have been obtained from investors. For example, an adviser will be restricted from charging or allocating fees and expenses related to a portfolio investment or potential portfolio investment (which would include broken deal expenses) on a non-pro rata basis when multiple funds and other clients advised by such adviser have invested or propose to invest in the same portfolio investment. The exception would be if it is “fair and equitable” under the circumstances and the non-pro rata charge or allocation and a description of how it is “fair and equitable” under the circumstances are disclosed to investors in advance.

As a result, it is expected that advisers will generally be required to allocate broken deal expenses to the fund and co-investors on a pro rata basis (rather than allocating all broken deal expenses to the fund), unless the facts are clear that allocating on a non-pro rata basis is “fair and equitable” (e.g., a co-investor’s participation in the co-investment is not binding or will be on a syndicated basis post-closing).

Larger private fund advisers (US$1.5B or more in private fund assets under management) must comply with the preferential treatment rule, the restricted activities rule and the adviser-led secondaries rule beginning in September 2024 and must comply with the quarterly statement rule and the annual audit rule beginning in March 2025. Smaller private fund advisers (less than US$1.5B in private fund assets under management) will have until March 2025 to comply with all of the new rules.

In the meantime, a group of private equity and hedge fund trade associations have filed a lawsuit against the SEC challenging the validity and enforceability of the final rules, which the industry will be keeping a close eye on. Unfortunately, the SEC has not been able to comment on some of the industry questions that are arising until after the conclusion of the litigation—accordingly, many questions remain.

Authors

Looking back at 2023, the rise in interest rates and public market dislocation that marked the start of the year contributed to a challenging market environment, which in turn led to real caution from market participants and created valuation gap issues. Secondaries markets were not immune to the deal friction experienced by the broader M&A markets. Accordingly, deals became somewhat difficult to strike in the secondaries space in the first half of the year.

As we moved through the year, distributions from private funds continued to slow, and liquidity became increasingly important to limited partners. This created additional motivation for sponsors and investors alike to find creative ways to manage their portfolios.

“The secondary market is increasingly being utilized by LPs for portfolio management to generate liquidity”, says Shane Feeney, Managing Director, Global Head of Secondaries, at Northleaf Capital Partners, “spurred by a range of factors including limited private equity distributions and the denominator effect”.

All this took place as interest rates started to level off, which helped lead to a gradually improving macroeconomic position. However, even with a relative increase in activity late in the 2023 calendar year, secondary transaction volumes have still not lived up to their full potential when viewed against the demand in the market for these types of deals. This is due in part to ongoing gaps in valuation between buyers and sellers, which have been slow to resolve.

Starting in Q3 and accelerating through Q4, deal activity in the LP-led secondaries space started to open up, as the bid-ask spread began to narrow and more viable transactions came to the table. At Torys, in particular, we saw increased fund interest and portfolio purchase and sale activity from both our institutional and secondary/fund-of-funds clients in the second half of 2023.

At present, there is significant dry powder in the secondaries space (estimated by Preqin as of March 2023 as being in excess of US$200 billion1), and many institutional investors would like to free up liquidity in the absence of traditional distributions from their fund sponsor partners. On the other hand, both secondary funds and funds-of-funds (as well as certain institutional investors) with dry powder to deploy are looking to be opportunistic and buy into existing funds at attractive valuations.

We expect that the increase in secondary deal volume seen in the latter half of 2023 will continue into 2024 and lead to increased growth in secondary deal volumes this year. That said, the renewed run-up in public markets in late 2023 makes it possible that valuation gap frictions will remain a consideration well into 2024 and continue to hinder deal execution in certain cases.

Given the challenges for sponsors looking for exits in M&A and IPO markets, we also expect to see accelerated growth in the GP-led space. While continuation vehicles are not without challenges—including increased complexity compared to traditional exits and investor concern around valuations and conflicts—limited partners are increasingly savvy to the ins and outs of these deals. We anticipate that GP-led secondaries will continue to be a tool in the ever-expanding toolkits of sponsors looking to return liquidity to their investor bases. The recent release of new SEC private fund rules requiring fairness opinions for continuation fund processes also speaks to the ongoing development of a consistent roadmap for implementing these processes from a market perspective.

In markets facing valuation headwinds, single and multiple asset GP-led deals represent an attractive way to achieve multiple objectives: injecting additional capital to specific assets in a portfolio, while extending the hold period for investments with more upside, and returning cash to investors that need it. In the current market environment, the use of continuation vehicles may also gain sponsor interest, as many closed-end funds approach the end of their terms without attractive exit options for prized assets. All this is coupled with increased fundraising activity in the secondary market space, which has created additional buyer capital looking for these opportunities.

Nevertheless, GP-led transactions still comprise a smaller portion of the secondary markets than their LP-led counterparts (GP-led deal volume fell materially in H1 2023 compared to H2 20222), and it is possible these deals will continue to face challenges in 2024 due to a combination of deal complexity and valuation considerations similar to those discussed above.

Secondaries funds represented one of the few bright spots in an otherwise difficult fundraising environment last year. As of December 2023, the year-to-date aggregate fundraising amount by secondaries funds was almost US$68 billion in 20233, according to Preqin (an aggregate amount surpassed only by the 2020 bull fundraising market), compared to less than US$40 billion in each of the 2021 and 2022 calendar years. Notably, this is in the context of a private fundraising environment which is on track to decline year over year as compared to both 2021 and 2022.

As institutional investors continue to become increasingly sophisticated in managing their secondaries investment strategies, our view is that the space for potential deal activity and fundraising opportunities in the secondary market will only continue to expand in the years ahead.

“Throughout much of 2023”, says Sid Murdeshwar, Managing Director at AlpInvest Partners, “sellers were still focused on a peak multiple vs. accepting the new pricing environment. As we move into 2024, sentiments may shift and as sellers become more flexible we should see more deals coming to market and it could be a very healthy deal environment”.

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Janelle Weed.

© 2025 by Torys LLP.

All rights reserved.