What do private equity stakeholders expect to see in 2025? Torys’ Private Equity Practice talks with industry leaders in our annual outlook. We share key highlights from our findings below.

We spoke with leaders from private equity, infrastructure, secondaries and venture capital funds, as well as institutional investors and other alternative asset managers, to survey the year ahead for private markets. One of the biggest themes that stood out was the consensus that macroeconomic factors like lowering interest rates were creating positive knock-on effects, making for a generally better deal environment overall. With much more in store for 2025, the industry participants in our report shared the following key insights:

Despite the tailwinds, the incoming Trump Administration and the Canadian general election may alter the course of the year, as buyers and sellers brace for potential changes in merger controls, investment flows and other market responses. President Trump’s proposed tariffs are at the forefront of concerns, which could potentially tip interest rates up, reduce consumer confidence and disrupt manufacturing and trade south of the border, among other possible impacts. However, anticipated changes to regulation in a second Trump term could benefit dealmaking, especially in heavily regulated sectors like energy and financial services.

In response to recent challenges affecting private equity over the last several years, the sector is recalibrating. As leaders hone their investment strategies, we expect to see continued creativity and resourcefulness to get deals over the finish line in an active year of dealmaking.

We would like to thank all those who shared their time and insight to create this report. From November to December, we interviewed 25 private market leaders. Several participating organizations requested anonymity; others are listed below.

Alphi Capital, AlpInvest Partners, Antin Infrastructure Partners, Birch Hill Equity Partners, BMO Capital Partners, CBRE Investment Management, Fengate Asset Management, DW Healthcare Partners, Imperial Capital, Maverix Private Equity, ONCAP, Ontario Teachers’ Pension Plan, OPTrust, Overbay Capital Partners, Peloton Capital Management, PillarFour Capital, TorQuest Partners, Vertu Capital, and Wittington Investments.

Our respondents generally agreed that dealmaking conditions will likely continue to improve in 2025. As deal-friendly macroeconomic forces prevail, there is a “significant opportunity for new platform investments for funds that have dry powder”, as Mohit Talwar, Partner at Maverix Private Equity, shares.

Some of the predicted accompaniments of an active market include the re-emergence of IPO listings, closing buyer-seller valuation gaps and increased competition for quality assets.

For 2025, sectors thought to be the most attractive to alternative asset managers include technology and energy, while other areas to watch include Canadian domestic manufacturing and industrials. Geopolitical and regulatory uncertainty may prove challenging, with increased antitrust enforcement likely to continue in addition to President Trump’s proposed tariffs, which could complicate dealmaking prospects. However, overall, there are reasons to be optimistic about getting deals done.

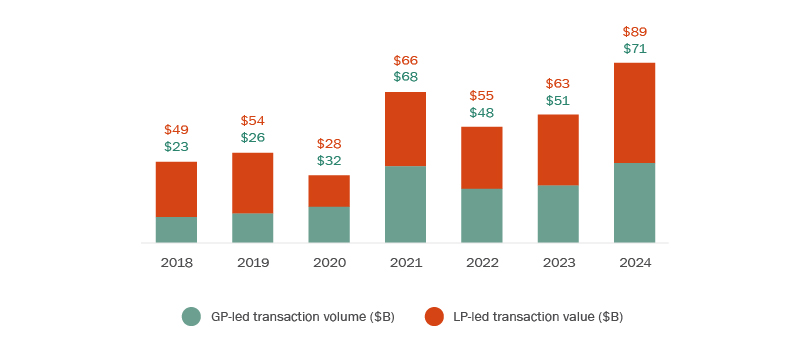

The secondaries market continues to grow, according to sponsors and investors we spoke with. As Neil Andrew of Overbay Capital Partners points out, “it seems like the secondary market is poised for another record year, with both buyers keen to deploy and sellers motivated to transact”.

60% of the leaders we surveyed indicated that secondaries were likely to stay the same or outpace 2024’s record-breaking year. LP-led secondaries may see increased activity as LPs continue to seek liquidity solutions and actively manage their portfolios. And GP-led transactions may see stronger growth as the incentive increases for sponsors to return capital to their LPs through traditional exits.

Co-investment vehicles have become more common to private equity after years of difficult fundraising, and they are likely to stick around for 2025. LPs are demonstrating that they want more for their capital, so as GPs continue to recover from a lack of exits and slow fundraising, “no fee, no carry” offers continue to trend upward. Further, as deals increase in value, co-investment opportunities may be another option to help get larger deals done.

Read our full report for more insider insights into the 2025 private market outlook.

Contacts

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Janelle Weed.

© 2025 by Torys LLP.

All rights reserved.